EBOOK

Peak Season 2020: Predicting eCommerce Patterns

Published: Sep 22, 2020

This report examines the impact of the COVID-19 crisis on eCommerce’s ‘peak season’ (Black Friday, Cyber Week, and December’s holiday shopping season).

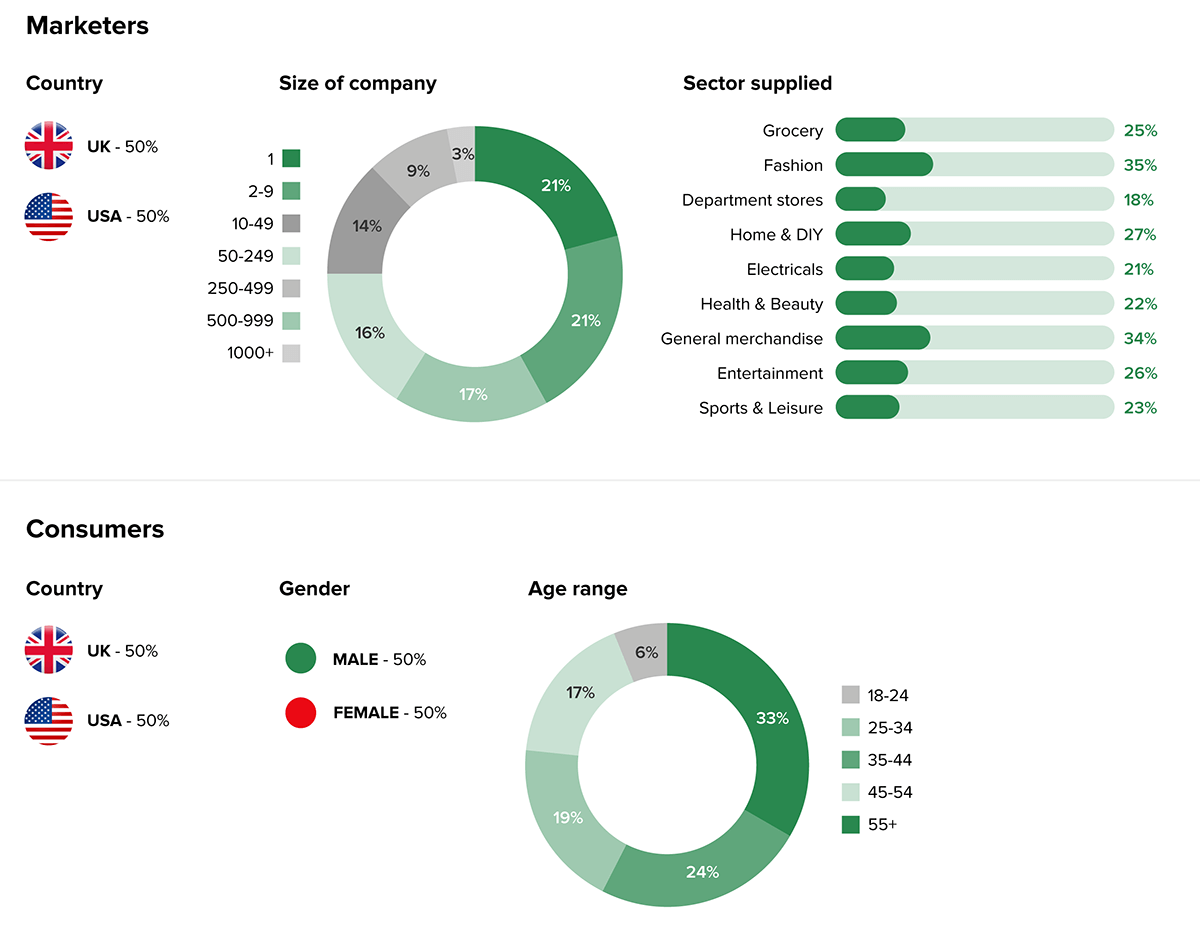

Based on research conducted in August 2020 with 400 eCommerce leaders and 2,000 consumers across the US and UK, it explores the current state-of-play for marketers and consumers alike, the challenges they face, and the opportunities available to meet revenue goals this peak season.

The key findings unveiled a forthcoming peak season unlike any other before it:

More eCommerce sites than ever are opting out of 2020’s ‘peak season’ campaigns. However, consumers express the opposite intention, planning to spend more than last year – and yet more of this will be online. This raises a clear contradiction between marketers’ priorities and what consumers really want.

Of those participating in peak season, marketers have adapted their strategies post-COVID to align with the shift in consumer behavior and the new challenges presented by the pandemic.

With less competition for an increased and more engaged customer base, eCommerce leaders have a great opportunity to increase market share this peak season…if they choose to take it.

Read on to discover what lies ahead in what’s set to be an extraordinary peak season.

Introduction: When Christmas Came Early

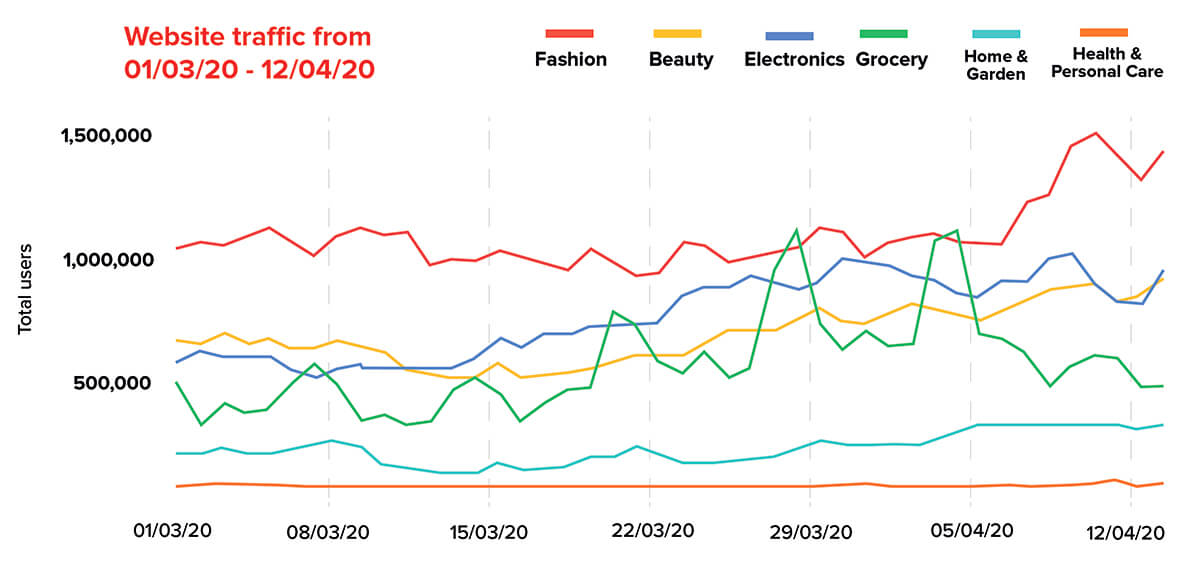

2020 has been a landmark year for eCommerce. COVID-19 has served as a catalyst for rapid growth across many eCommerce sectors as consumers turned their attention online amid store closures and lockdown restrictions. For many eCommerce companies, ‘Christmas came early’, as ‘peak season’ levels of traffic hit in April.

In March there was a 74% growth in average transaction volumes compared with the same period last year.

This boom, while positive in the short-term, has created added complexity for eCommerce leaders this peak season. With uncertainty still at play around when the ‘new normal’ will begin, many companies are approaching this year’s peak events with caution.

The game has indeed changed, but with that change comes opportunity. Our next chapter explores the first of those.

The Peak Season Paradox

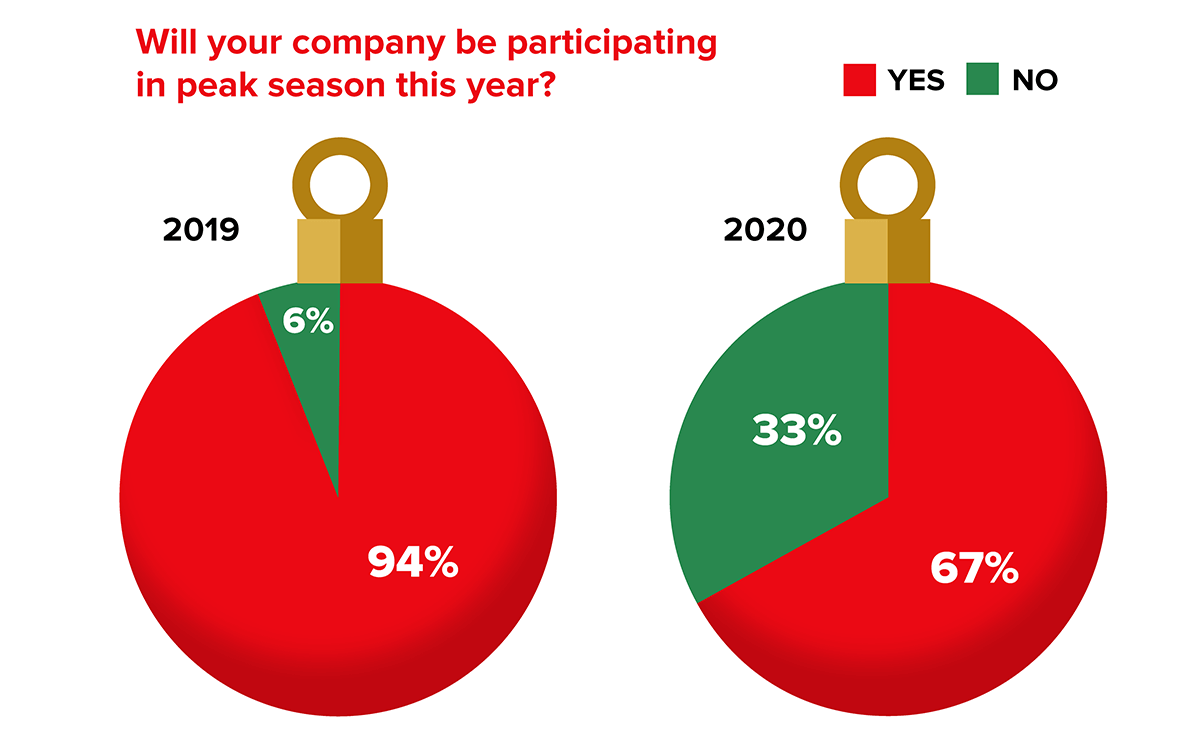

The pandemic has forced all companies to take decisive action to protect their customers, employees, brand, and revenue. The impact on peak season is shocking: More companies than ever are choosing to opt out.

The year-on-year decrease in participation across all peak season events is stark. Over 33% of eCommerce companies are choosing to opt out of peak season activities in 2020, versus only 6% last year.

This is reflected in the world of brick-and-mortar. Walmart revealed that it will close all of its stores across the US on Thanksgiving this year, ending its tradition of Black Friday deals. Other brands such as Macy’s have followed suit, looking to add focus to online deals and offer curbside pick-up as their ‘big secret weapon’.

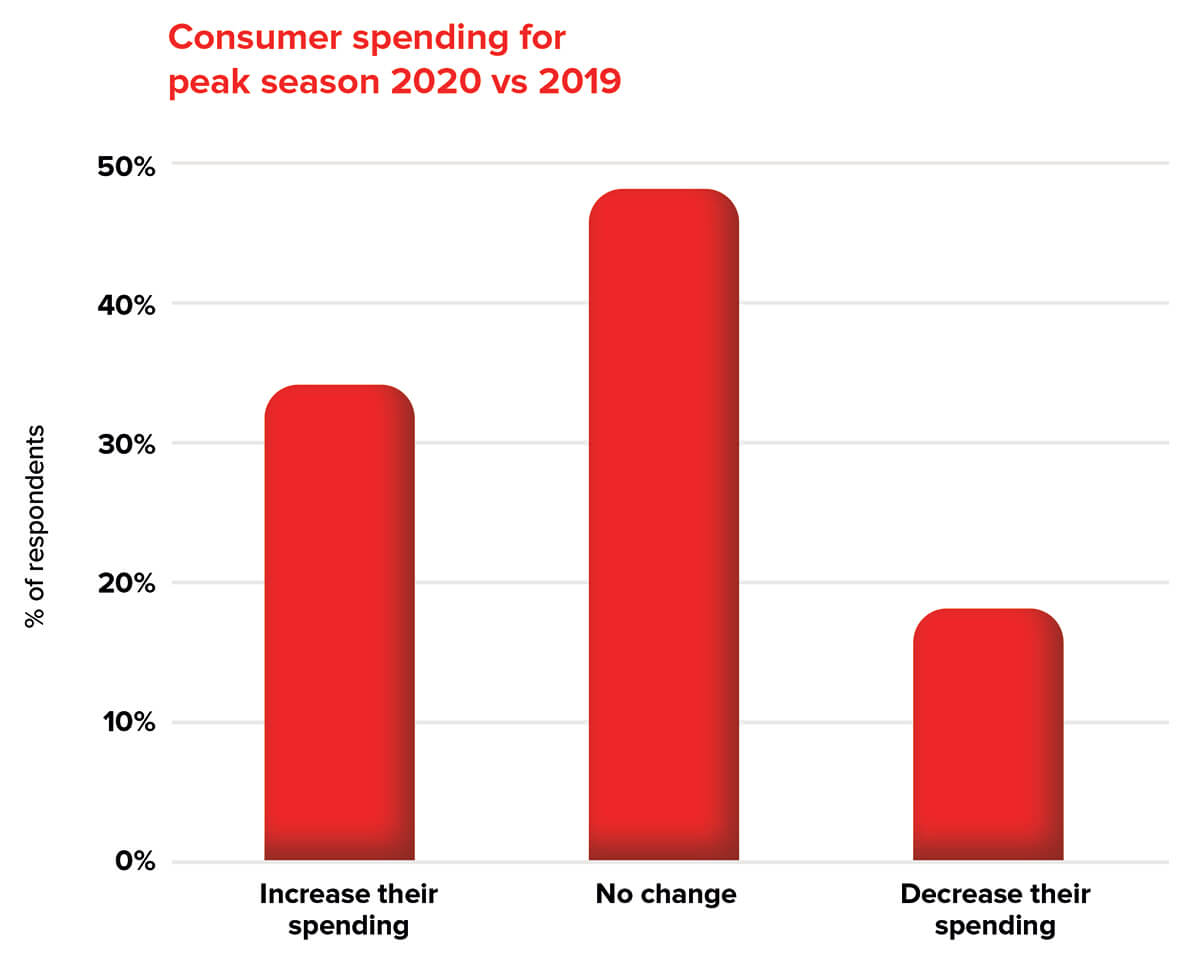

However, there’s evidence to say that the decision to opt-out may be a mistake. This is because the consumer view indicates trends are moving in the exact opposite direction: A significant increase in peak season participation. 34% of consumers plan to increase their peak season spending year-on-year and only 18% plan to decrease it.

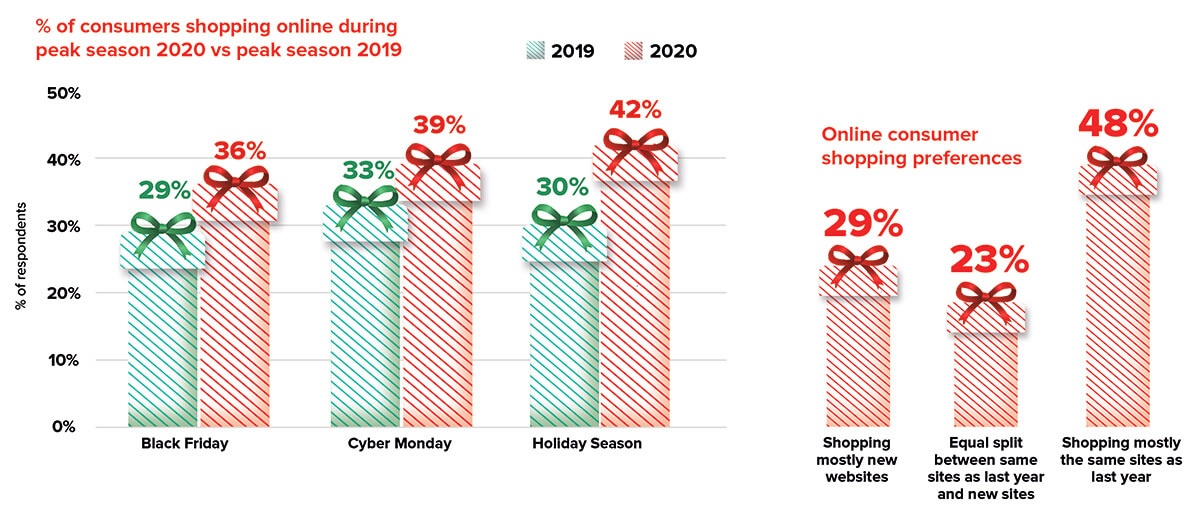

Even more important for eCommerce companies, this increased spending is even more likely to be online. More consumers plan to undertake their peak shopping online this year across all three peak events, with an average 8pp. growth predicted for consumers shopping either mostly online or only online.

There’s even more for eCommerce companies to consider when looking at where consumers plan to shop online. While 48% of consumers plan to shop mostly on the same websites as last year’s peak season, nearly one-third (29%) plan to shop on mostly new websites. This indicates that the discovery of new online shopping habits from COVID will ‘stick’ for peak season this year.

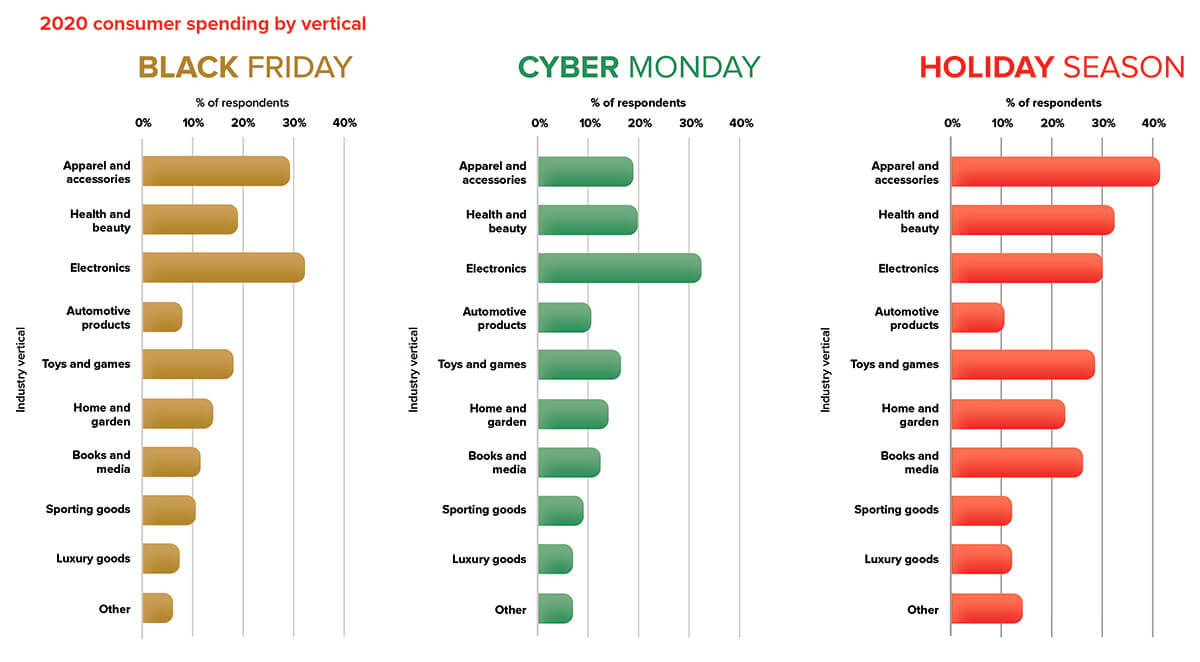

Looking at what consumers wanted to buy, the results differed between each peak event. For Black Friday and Cyber Monday, electronics reigned king, whereas apparel and accessories were most popular for the holiday season. So a large proportion of eCommerce leaders are opting out of peak season, while consumers are wholeheartedly opting in. So why the disconnect?

Caution vs Optimism

Choosing to pull back from the biggest period in the online sales calendar just after the industry leaps ahead would at first appear confusing. On closer examination, the reasons for doing so become clearer.

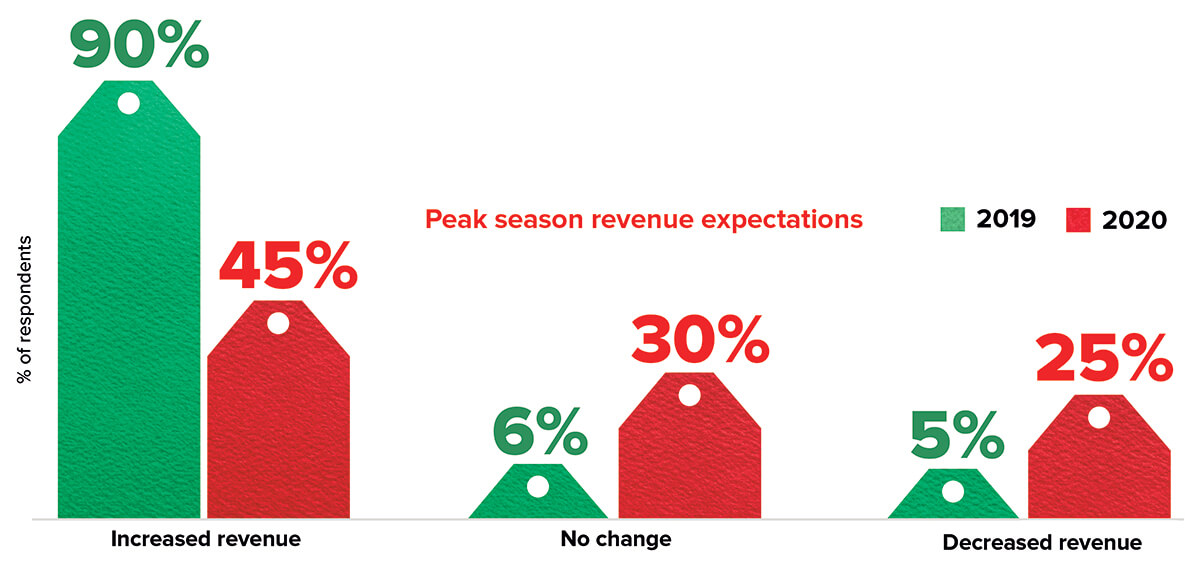

Firstly, there’s a clear atmosphere of caution amongst eCommerce leaders, who are unsure about whether COVID will dampen 2020’s peak season. While in 2019 nearly 90% of marketers expected to outdo their previous year’s results, only 45% are so positive this year. There’s even a 20pp. increase in brands expecting a year-on-year decline.

This expectation of a low financial return has likely forced eCommerce companies to interrogate the ROI of peak activities this year in a way they haven’t had to before.

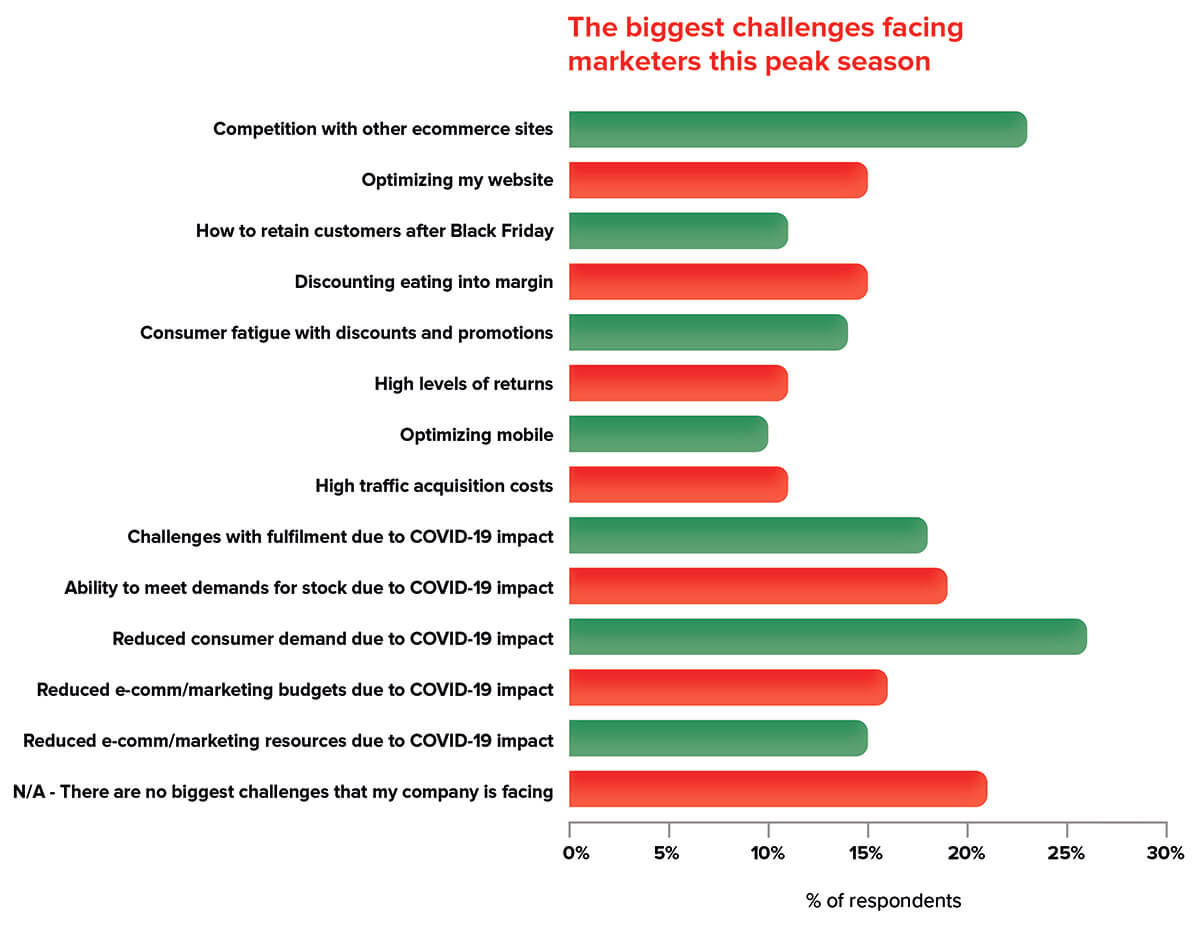

eCommerce leaders revealed more concerns besides revenue, characteristic of the challenges of operating in a pandemic. The ability to meet demand was a key reason for opting-out, recalling challenges with fulfillment services and supply chain management.

However, ranking even higher was the assumption that consumer demand would be low and that competition would be fierce – both of which appear to be refuted by our consumer insights.

On the subject of consumer demand, it makes sense now to turn to consumer motivations for opting in, having looked at marketer motivations for opting out.

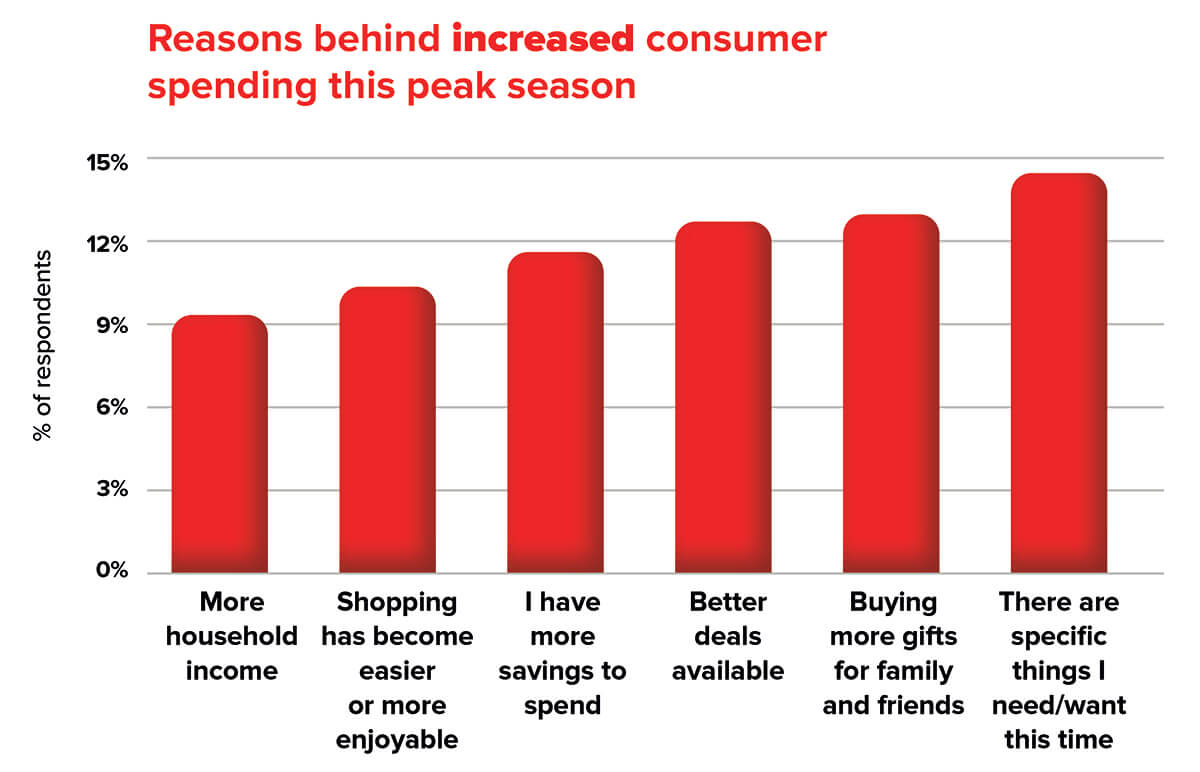

Of the consumers planning to increase their spend this peak season, the largest proportion were doing so because they had specific things they needed. This suggests plenty of high-intent purchases come peak season,

for which marketers should start nurturing consumers as soon as possible.

In terms of priority, this was followed by buying more gifts for friends and family. With lockdown conditions meaning fewer gifts being given in person, it makes sense that more people will be shopping online to send gifts directly to loved ones.

2020 conditions aside, the data uncovered another important area of divergence in opinion between marketers and consumers. Over the last few years, Black Friday and Cyber Monday have been viewed with more skepticism – notable brands have pulled out, and many have reshaped

their campaigns away from blitzes of discounting into more brand and value-driven campaigns.

This year has seen this opinion become even more pronounced for eCommerce leaders, with more than one in five saying that they believe consumers think it’s a ‘marketing ploy’.

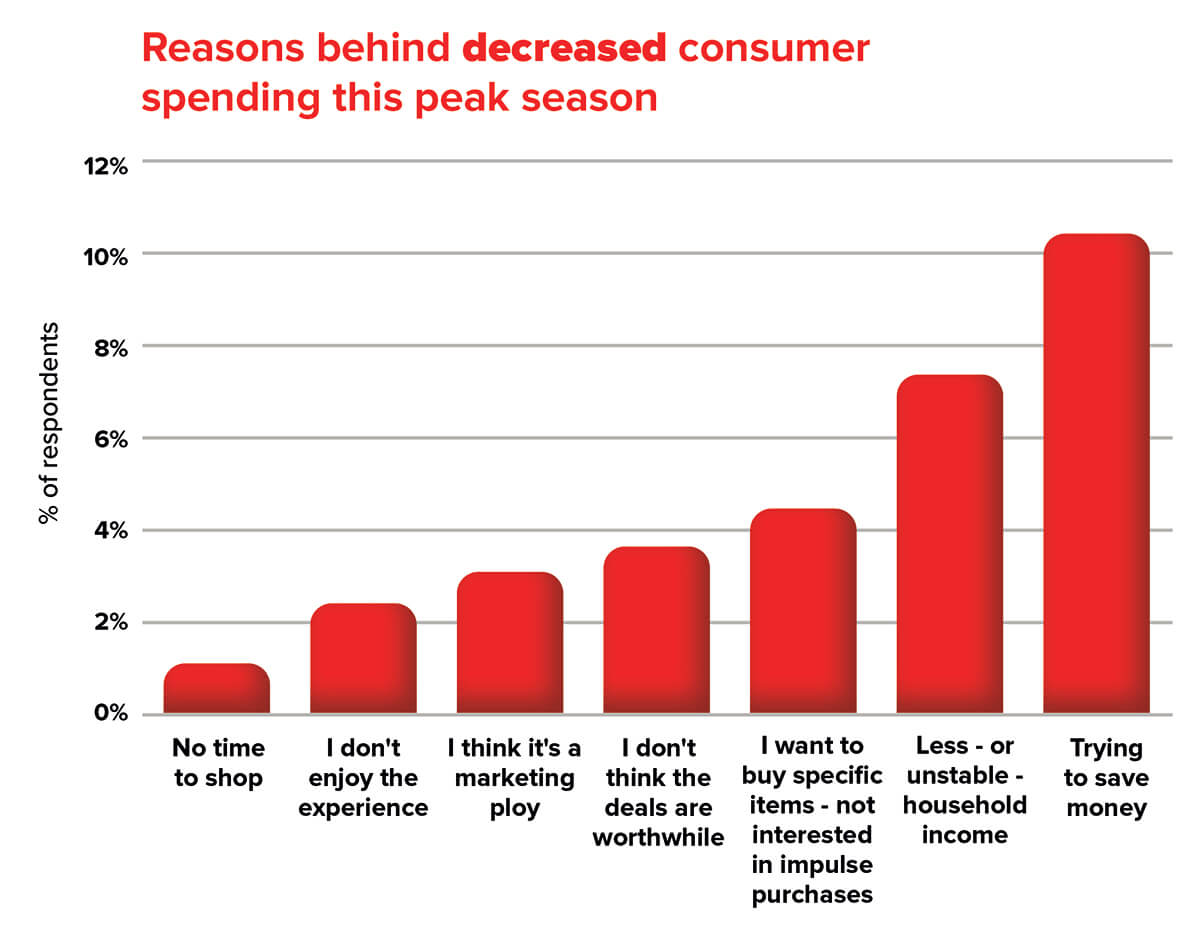

However, once again, this is where marketers may have misread consumers. In truth, only 3% of global consumers think Black Friday and Cyber Monday are a marketing ploy. Instead, of the consumers spending less this year, the biggest reason was that they were trying to save money, followed by having less or unstable incomes. Neither of these reasons support marketer concerns that consumers hold a negative opinion

of Black Friday or Cyber Monday.

With such a clear disparity between corporate caution and consumer optimism, it gives brands currently on the fence about their holiday season campaigns a reason to re-think.

Below, a few eCommerce professionals share their thoughts both ‘for’ and ‘against’ participating in peak season activities. Here is what they shared:

The pros of participating

“With Salesforce predicting that up to 30% of global retail sales will be made through digital channels this upcoming holiday season, it looks like a no brainer for retailers to engage in peak season.”

“Consumers have been supporting businesses online where they can, so the retailers feel that if they hold their prices then it won’t affect their regular sales. Even bargain hunters are stumping up the cash to pay

Chans Weber / Founder & CEO / Leap Clixx

regular prices in support of businesses – online and in-store.”

“Simply put, crowded, closed-in spaces are not popular and won’t be for quite some time to come. While some people are eager to go back to stores and shop, particularly for the holidays, many others are planning

to remain at home and have their holiday packages delivered.”“This is going to set up an odd dichotomy wherein retailers try to get the best of both worlds. Where Black Friday is likely to see record low turnout, Cyber Monday will likely shatter records for participation and revenue generation.”

Garrett Greller / Co-Founder / Uncle Bud’s Hemp

The cons of participating

“This year we’ve noticed that many of our retailers are not very enthusiastic about peak season activities, they require an increase in workforce and investment. The pandemic forced recession has made many retailers risk-averse, so do not want to risk investing while they’re running on losses.”

“There is also the scare of a second or third wave of pandemic hitting again and forcing another lockdown. Such a circumstance would be disastrous for all businesses, especially retailers. A retailer who’s invested too much would sink. The ideal strategy adopted by retailers is to survive this year and save up for next year.”

Ian Kelly / VP of Operations / NuLeaf Naturals

“Marketing dollars are like gold and retailers are leery of wasting money in a space that’s not helpful. The economy is still shaky, and retailers aren’t entirely sure that consumers will be buying much this year, especially since it’s unclear whether another round of stimulus checks are coming from the government.”

“To make matters worse, retailers have to worry about whether inventory will be accurate or not due to delays in the delivery process. Backordered items will be a nightmare for holiday gifts and items showing as ‘out of stock’ for too long can hurt an online business presence.”

Vinay Amin / CEO / Eu Natural

What Peak Participation Looks Like Post-COVID

For those eCommerce leaders deciding to participate in peak season, what kind of landscape can they look forward to facing? This chapter looks to answer that question.

Firstly, the indecision over participation in 2020’s peak season is reflected in the huge changes to the planning cycle. By September last year, nearly 70% of eCommerce companies had already started their peak season planning: This year, that number dwindles at less than 40%.

There are clear signs that some brands could be rolling the dice and holding off on making decisions until the very last minute – a plan which has the potential to backfire.

When looking at the types of promotions being run, there’s a clear drop in what companies are offering.

Discounts remain king, offered by 41% of participants (compared to over 70% last year), followed once again by free gifts and shipping. The overall decrease in ‘generosity’ may be a reflection of caution over the ability to fulfill offers, as well as a perceived lesser need to attract conversions.

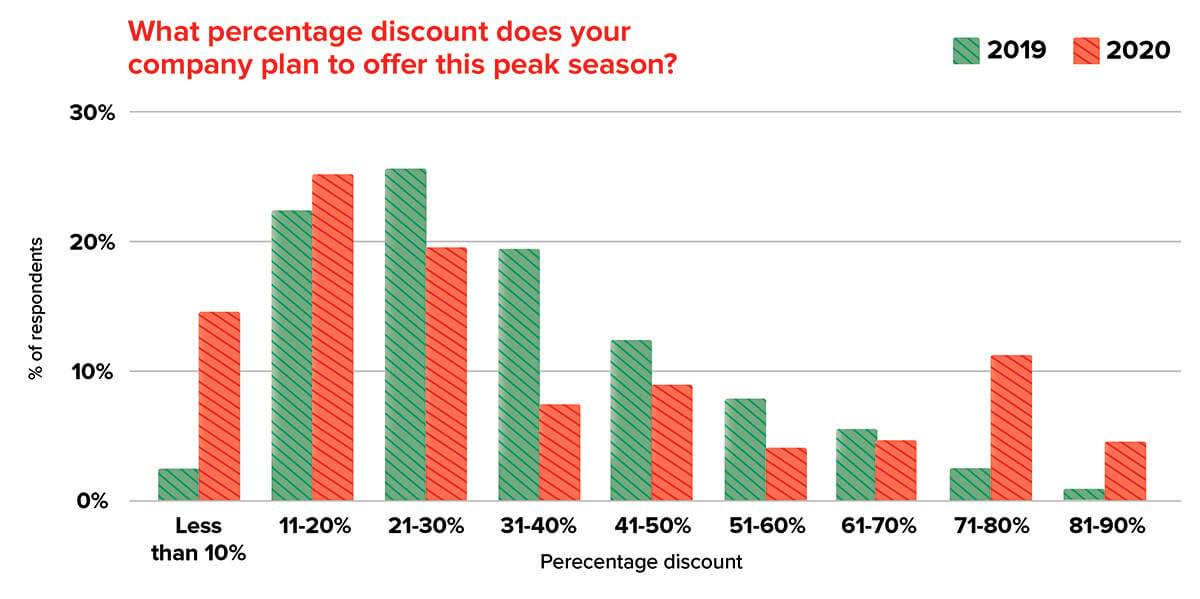

The largest proportion of retailers plan to offer an 11-20% discount and the largest increases year-on-year were seen at the very lowest and very highest end of the scale – further underlining the “all or nothing” approach.

“One reason many eCommerce retailers may be offering less peak season discounts and offers this year is that everyone is shopping online already anyway since COVID, so many eCommerce stores are doing well enough that they don’t feel a pressure to participate in giving more discounts.”

Stacy Caprio / Marketing / AcneScar.org

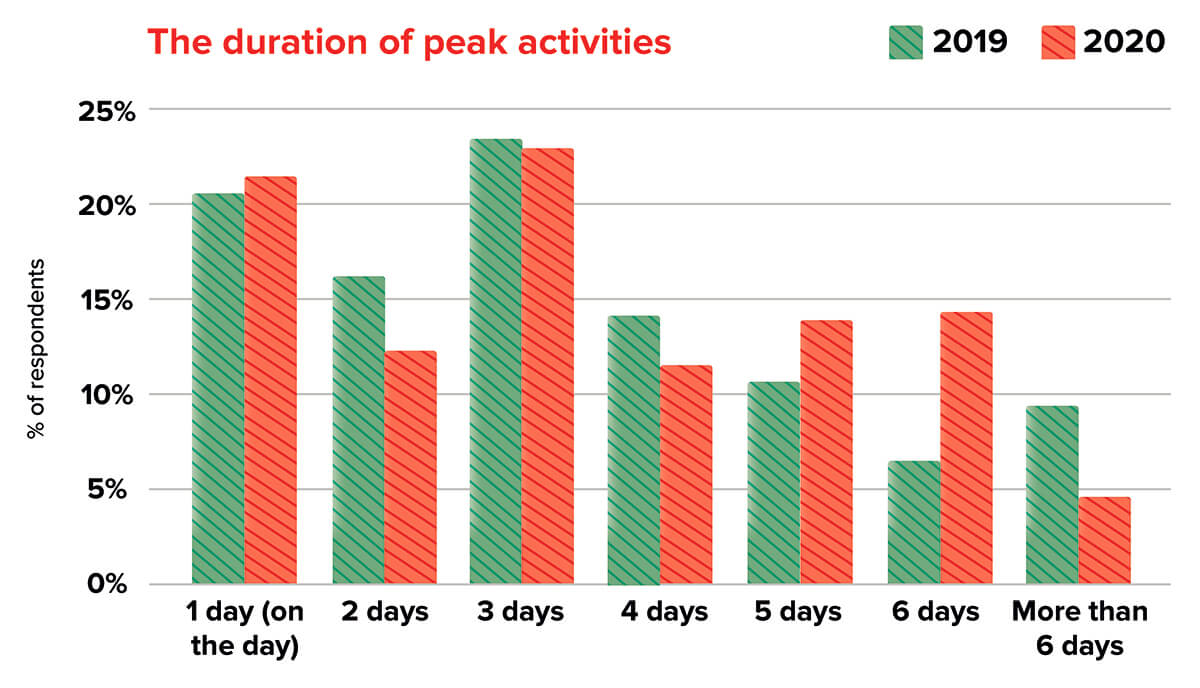

There are also signs that Black Friday and Cyber Monday will last longer, a trend that has been emerging over the last few years as retailers seek to fully grasp the opportunities that peak season brings. The five and six-day time periods saw the largest increases year-on-year and the largest proportion of retailers opted for 3 days (in line with 2019).

“This unprecedented holiday season will see customers shopping on irregular schedules. An abnormal back to school season coupled with a delayed Amazon Prime Day means shoppers will likely spread out holiday spending and start buying earlier.”

Meaghan Brophy / Retail Analyst / FitSmallBusiness.com

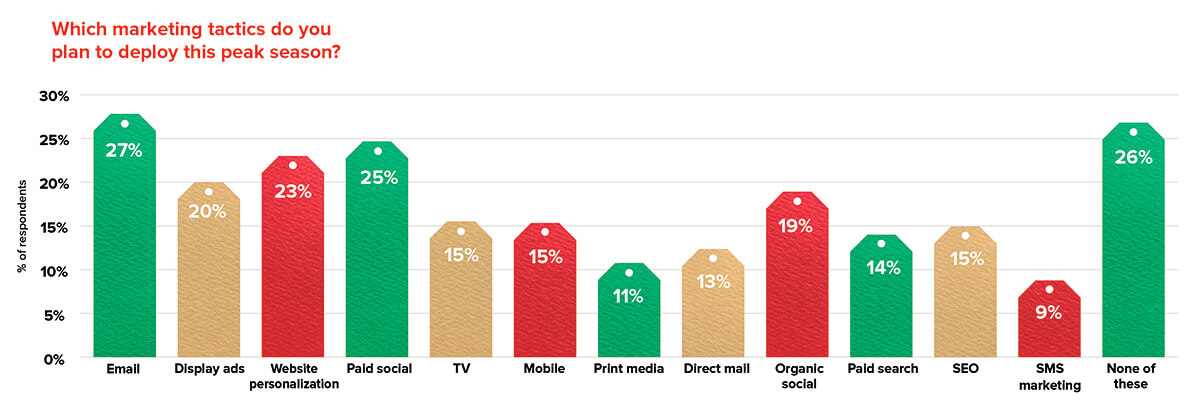

Looking at the tactical executions planned to meet marketing goals this peak season, email marketing came out on top. This was followed by paid social and website personalization.

With inboxes set to be more crowded than ever and increased volumes of online traffic expected, personalizing on-site experiences and email marketing will be crucial to differentiate brand offerings and attract those all-important conversions from new and returning visitors alike.

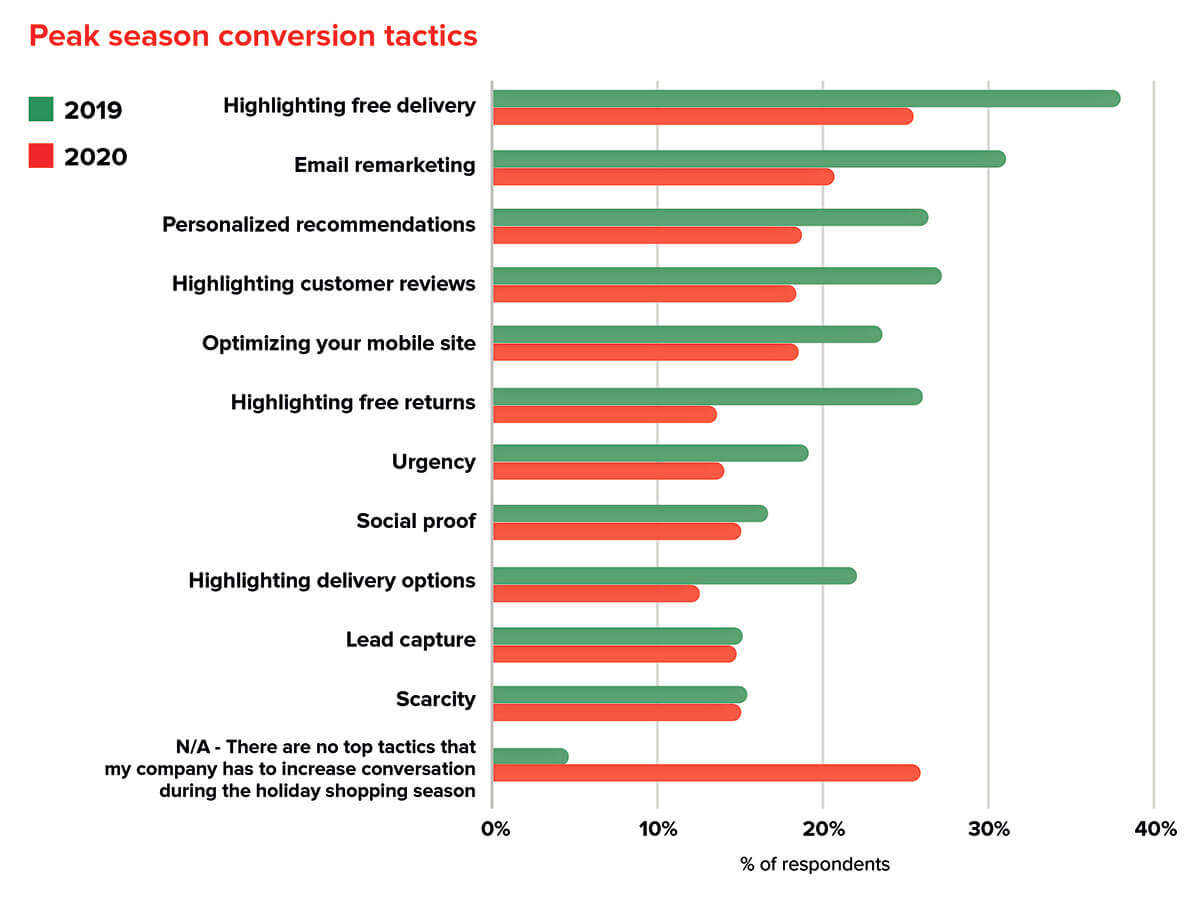

For conversion-specific tactics, the most popular tactic this year was highlighting free delivery, followed by email remarketing.

These tactics work two-fold, with the former encouraging in-session conversions and the latter serving as a fallback where needed upon cart abandonment.

This means optimized lead capture forms play a crucial role for marketers in both their ability to send promotional emails to the widest audience possible and re-capture the attention of visitors that left without making a purchase.

10 Actionable Tips to Win This Peak Season

In 2020’s peak season, eCommerce consumer demand is set to be higher than ever – coupled with decreased competition thanks to other companies opting out, this creates a golden opportunity. Check out these actionable tips to win this peak season (and head over here for even more holiday eCommerce CRO tactics):

- Against a backdrop of brands opting-out, make sure that consumers are fully aware that you will be offering holiday promotions well ahead of time. 60% of consumers who made purchases on Cyber Weekend 2019 engaged with an email from that brand prior to Q3 that same year – so start your lead capture early and nurture through Email and SMS.

- Even your most loyal shoppers might not be aware of upcoming promotions, so connect your visitors to your holiday calendar and encourage them to create wishlists.

- On your website, use clear messaging to help set expectations and reduce the burden on resources such as customer service. Use these to point visitors in the direction of key information such as shipping deadlines, FAQ pages, and customer service contact information.

- In anticipation of increased consumer demand and potential shipping delays, set clear and early shipping deadlines to ensure timely delivery. Counting down to delivery deadlines is an incredibly effective tactic to nudge procrastinating gifters into converters.

- Deploy an optimized lead capture form to target any new browsers that might visit your website as a result of increased demand. Track their online behaviors and preferences, then use these insights to follow-up with personalized cart abandonment emails and enroll them in email marketing campaigns.

- Do you have items that can make a nice addition to any holiday basket? Consider an embedded cross-sell on your cart or checkout pages. This is an effective way to call attention to overlooked holiday products and increase cart size.

- FOMO (fear of missing out) is a powerful motivator, and with holiday shoppers looking online more than ever, social proof will be an effective way to build urgency on product detail pages and drive conversions. Tried and tested ways to do this include featuring customer reviews and star ratings, showing stock levels, displaying endorsements, showing “other people bought” and highlighting best sellers.

- Remind visitors of past shopping sessions and streamline their progression to checkout. Notifications that appear upon re-entry to your website can be effectively combined with urgency tactics like inventory warnings and discount deadlines to drive speedy conversions.

- If you have offers that depend on cart value, consider using a progress bar. These are a great way to help shoppers track their progress towards being eligible for offers, and encourages them to spend more to get more.

- Prepare your post-peak season game plan. You’ll likely acquire a volume of new customers once campaigns kick-off, but how are you going to turn a one-off purchase into meaningful lifetime value? Before the new customers arrive, make sure you have a strategy in place to nurture them into multiple purchases.

In Conclusion

Whilst COVID-19 has created huge change and disruption for eCommerce leaders, there’s value in staying the course when it comes to peak season. Consumer appetite for deals is stronger than ever, and more of them are shopping online in ways we would never have expected this time last year.

While the chaos (positive and negative) that 2020 has given our industry would give any eCommerce leader good reason to be cautious and pull back from peak, the data here should give anyone reason to reconsider. The key thing is to be decisive but build in flexibility so you can adapt to any bumps in the road that Q4 might bring.

Ultimately, the eCommerce brands that win this year will be those who listen best to their consumers – good luck and have a great peak season.

Appendix/Methodology

Three online surveys were conducted with a panel of potential respondents. The recruitment periods were 8th July 2019 to 17th July 2019 and 31st July 2020 to 21st August 2020.

A total of 400 respondents completed the first two surveys. These were made up of 200 respondents residing in the UK and 200 respondents residing in the US. Only senior marketers or eCommerce directors at retailers with an eCommerce presence were eligible to take part and complete the survey.

A total of 2,000 respondents completed the third survey. This was made up of 1000 respondents residing in the UK and 1000 respondents residing in the US. Only adults aged 18 or above were eligible to take part and complete the survey.

All questions within the surveys were verified to be MRS compliant by a marketing research company specializing in online and mobile polling.