EBOOK

How We Book Now

Published: Jun 5, 2019

Introduction

Just like no two vacations are the same, no two customer journeys are the same.

With continued evolution in digital booking, the opportunity to book how, when and where you want grows by the day. Where the travel booking journey was once fairly linear, there’s now a never-ending multiplicity of customer journeys, each of which are complex are in their own right.

Knowing this, you’d be forgiven for wondering where to start as a travel marketer. At Yieldify, we work with hundreds of travel websites around the world – from monoliths such as Megabus to smaller package holiday sites. We’ve seen that amongst the complexity, there are clear trends to be found if you know which segments to look at. So that’s what we’ve done here.

Surveying over 1000 UK and US consumers who have researched or purchased travel products online in the past year, we asked them about how, where and why they book their travel. In addition, we interviewed key thought leaders in travel marketing to add color to the data.

The resulting report is a fascinating picture of booking behavior and how much it differs by five key segments: generation, gender, vacation type, market and product. Each of the following chapters not only illuminates current customer behavior and expectations, but reveals numerous opportunities for brands to improve the customer journey through personalizing to a segment’s specific needs.

Read on to find out ‘how we book now’…

The Contributors

This report is the result of quantitative research and interviews with the following audiences and individuals:

- 1005 UK and US travel consumers*

- Eilidh Whyte, Group Airline Display and Affiliate Manager, Thomas Cook Airlines

- Wai Lin Yip, Corporate Director E-Commerce, Arlo Hotels

- Sarah Hawkins, Senior Digital Optimization Executive, Virgin Trains

- Marie Tracy, Group Marketing Manager, TravelUp

- Sophie Herbert, Marketing Director, Beds and Bars

- Mark Murray, Head of Travel, Yieldify

*This research was conducted by Censuswide, an independent market research consultancy, with 1005 Respondents who have researched and purchased travel related products online in the last 12 months: 503 in the UK and 502 in the US. Fieldwork was carried out between 09.05.2019 – 14.05.2019. Censuswide abide by and employ members of the Market Research Society. All survey panellists are double opted in, which is in line with MRS code of conduct and ESOMAR standards.

Executive Summary

Over the last decade, technology has transformed how consumers book their travel, but not how you might expect…

One of the biggest changes technology has brought to travel is the ability for consumers to plan and book every bit of their holiday without the need for a third party such as a travel agent. But while innovation has made this possible, it hasn’t necessarily made the experience more efficient: consumers are now spending more time planning and booking trips.

Below, we break down the stages of the travel customer journey, highlighting the key findings from our research.

Planning a trip

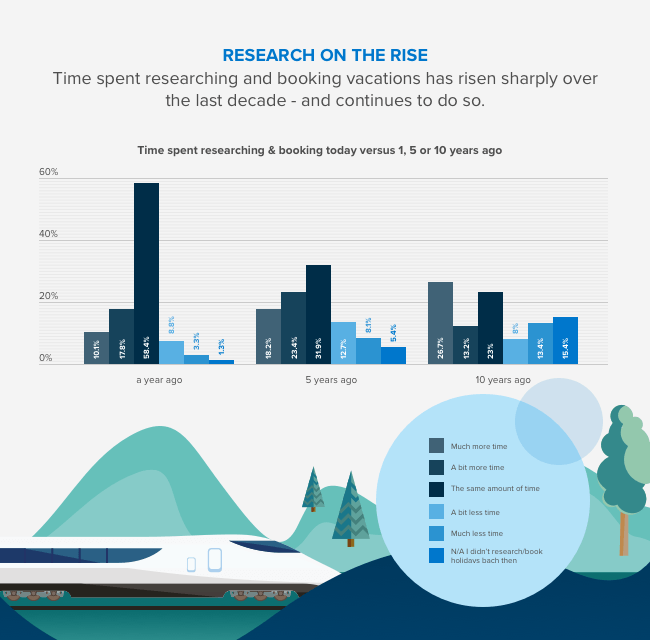

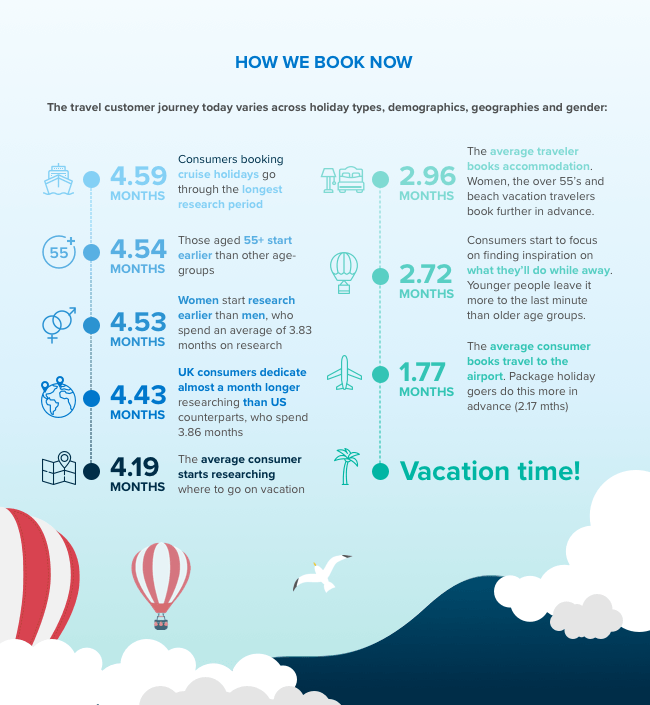

The average customer now starts to research where to go on their next trip 4.19 months before departure, with 41.7% spending more time on research and booking than they did five years ago.

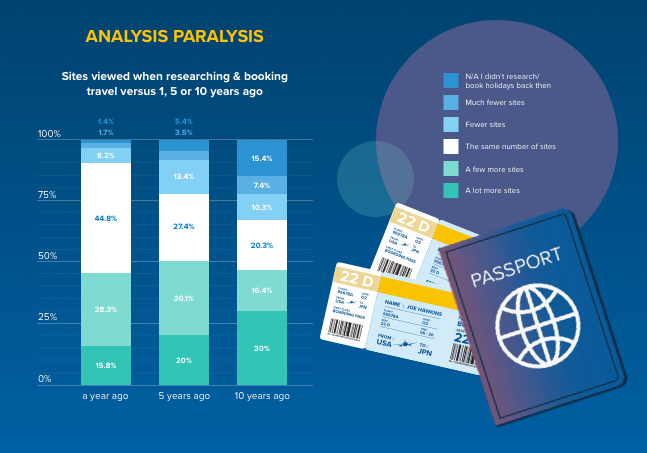

In 2013, research from Expedia found that customers browse upwards of 38 sites before purchase — our research shows that customers are now likely to be visiting many more across the 4+ months they spend researching and booking.

The question is – why?

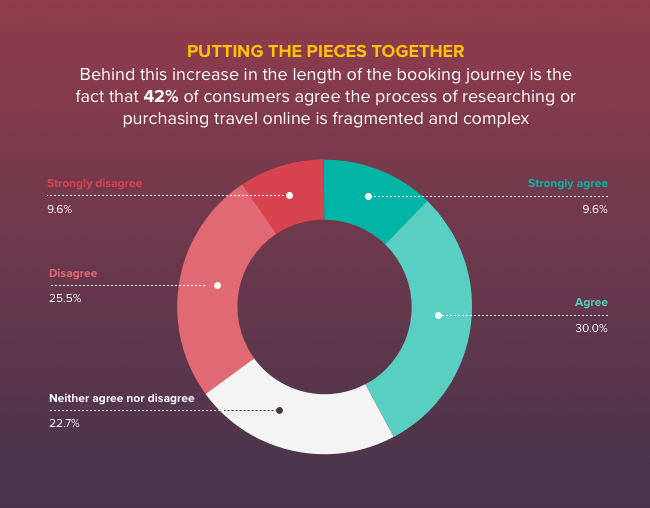

The increasing complexity of the customer journey is part of the answer. Now that consumers act as their own travel agents – many of them booking each part of their vacation separately – there are multiple purchase journeys to each trip. More than four in ten (42%) of consumers agree the process of researching or purchasing travel goods online is fragmented and complex:

‘Analysis paralysis’ also lies behind the lengthiness of booking: as the number of travel websites has exploded, the research stage of the customer journey now has no limits. This means a longer booking funnel, with more work for consumers, and more chances to lose them.

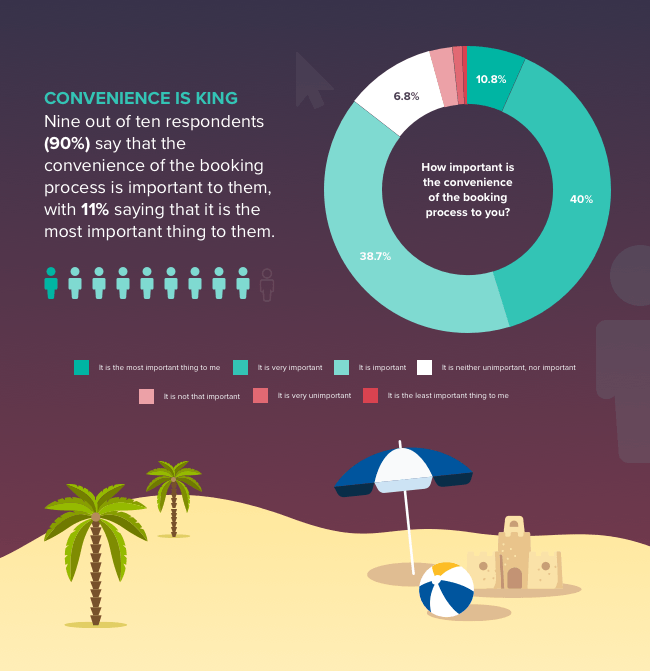

Making a booking

What drives consumers to book varies across demographic, market and type of travel product, and this report will deep-dive into each. But what’s clear is that convenience is king – nine out of ten respondents (90%) say that the convenience of the booking process is important to them.

As ever, there are contradictions – despite their love of convenience, almost eight in ten (78%) travelers say that they always visit multiple sites when deciding where to go on holiday — although 75% would be happy to book all aspects of their holiday on one site.

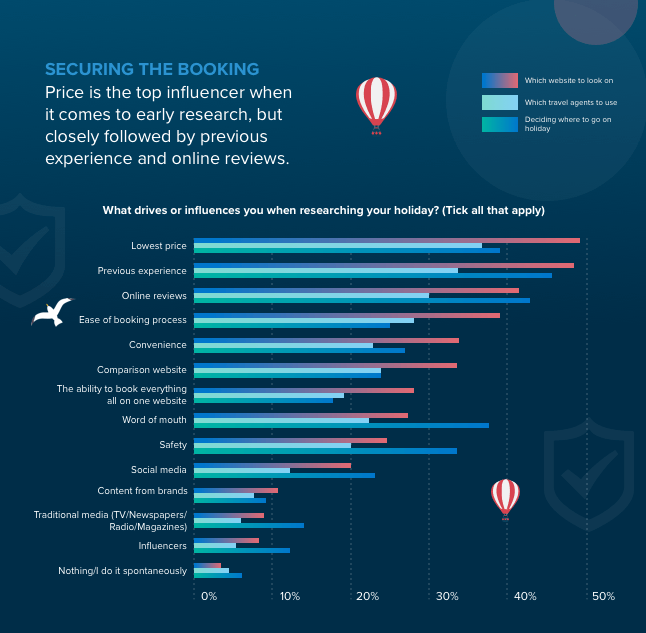

When it comes to deciding which sites to visit, travelers still cite price as the top motivator, but this only just edges previous experience (48.6% vs 45.7%), indicating the importance of cultivating loyalty as a travel marketer.

Reviews (41.3%), an easy booking process (39.4%) and comparison websites (33.5%) also play a key role in consumers choosing to visit travel sites, highlighting how the metasearch experience has become the norm in the eyes of the consumer.

Personalizing the customer journey

In seeking to deliver on consumer need for trust and convenience, travel brands have turned to personalization. But what do consumers make of these efforts?

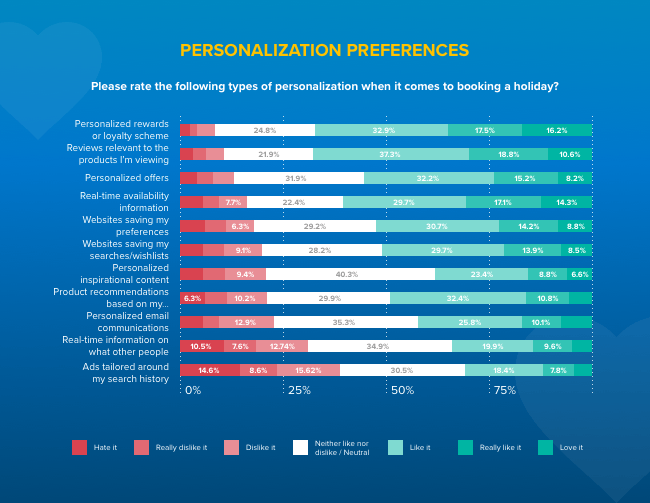

Consumer attitudes towards personalization are somewhat contradictory. Despite privacy concerns, travelers are broadly in favor of a personalized experience when booking a holiday. This is not surprising, given that many applications of personalization make the customer journey smoother – recommendations, real-time availability and saved preferences were all rated positively.

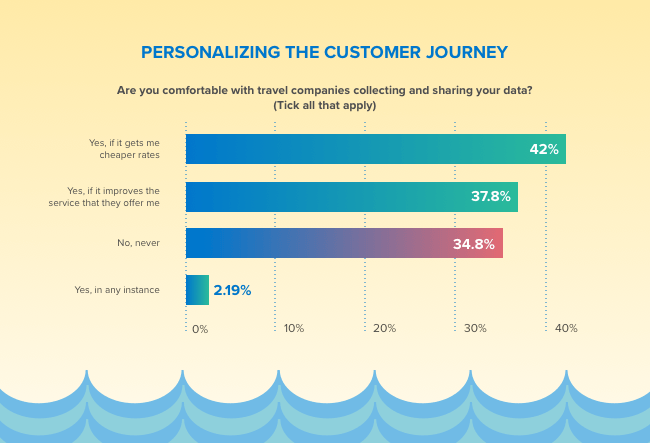

For consumers, ‘good’ personalization is all about the value exchange – consumers are willing to share data if they’re getting something in return. According to our research, over a third (35%) say that they’re not comfortable with brands collecting and sharing their data. They are, however, willing to share their data if they get something in return, such as cheaper rates (42%) or improved service (38%).

Personalization is the key to delivering a more seamless customer journey, but many travel brands struggle to get this right. “In terms of personalization, travel is a little behind the retail sector, but it’s catching up fast,” explains Mark Murray, Head of Travel at Yieldify.

“Data is getting bigger and bigger each day, but harnessing it effectively to serve the right experience to users with the right content is becoming key.”

Mark Murray, Head of Travel, Yieldify

It’s become a priority for brands seeking to stand out from the crowd, as Sarah Hawkins from Virgin Trains explains: “In terms of what I’m excited about when it comes to trends within travel, personalization is a big one. People expect it now – they want to be spoken to directly, they want content that’s relevant to them and they want to book quickly and easily.”

Booking Behavior by Generation

The first of our spotlights is on generational cohorts. With much of the shift in the travel customer journey being driven by digital innovation, we sought to find out whether this has had selective impact on different age groups.

Planning and booking

As a general rule, advance research and booking behavior increases with age: 16-24 year olds spend the least time, starting 3.82 months in advance, while 55+ start the earliest (4.54 months in advance).

These older age groups, despite tending less towards digital channels, are still visiting more websites than they used to. More than one in five (22%) of those aged 55+ are visiting a lot more than they did 10 years ago.

When it comes to the fragmentation of the online travel journey, it’s actually 16-24-year-olds who find it most complex (52%). But it’s 25-34 (37%) year olds who report the biggest increase in the amount of time they’re now spending on planning a trip – presumably as a cohort rising in disposable income their options expand and with it, the time they spend choosing between them.

Unsurprisingly, when it comes to the factors influencing visitors to make the booking, it’s those aged 16-24 who are most influenced by social media (43%). In addition, 20% of those aged 16-24 and 18% of those aged 25-34 are inspired by influencers when deciding where to go on holiday.

Personalizing the customer journey

Personalization depends on the availability of data, and willingness to share this decreases with age. Younger consumers were happy to share data in exchange for something of value – 47% of 25-34-year-olds are willing to share data in exchange for cheaper rates, which fell to 34% for those over 55. Younger consumers were also more receptive to sharing data in exchange for an improved service.

Where it gets really interesting is the different types of personalization preferred by different age groups. People aged 25-34 are most likely to ‘love’ real-time availability information (20%), reviews (15%) and personalized offers (11%), and one in five cost-conscious 16-24-year-olds ‘love’ personalized rewards or loyalty schemes.

Tailored advertising is the least popular type of personalization: 39% of respondents overall dislike this, with 15% saying that they ‘hate’ it. Those aged 55+ are most likely to feel this way (19% ‘hate’ it). Real-time information on what other people are looking at – a much-used tactic by many booking engines – was also unpopular: 31% of respondents dislike it and 11% ‘hate’ it. Those aged 55+ were the least impressed (17% ‘hate’ it).

What it means for travel marketers

When it comes to creating a better customer journey for younger consumers, it pays to focus on reviews and have an active social media presence. Many travel brands now work closely with carefully-selected influencers. Wai Lin Yip, Corporate Director E-Commerce, Arlo Hotels explains:

“We work with a lot of influencers from all around the world. Once a couple of them stay, and tag us, they all find us. We pick a select few and host them for their stay.”

Wai Lin Yip, Corporate Director E-commerce, Arlo Hotels

She continues: “Guests these days are very savvy. They go online, they look at reviews, they look at images, they see what we’re doing, what kind of events we have. We are very active on social media. Even before they arrive guests are asking us questions on Facebook, on Instagram, and we answer them over DM. Consumer expectations mean that they want answers fast.”

For older consumers, building trust is key given their unwillingness to share data. Previous experience is the most important factor for over half of those aged 55+ (52%), so here is where travel marketers would do well to look at their customer retention strategy, especially considering that 1 in 5 of this age-group are shopping around more than they used to.

In focus: The March of Metasearch

More than one in five customers (22%) say that they are influenced by comparison websites when booking flights, and more than one in three (32%) are driven by these when booking hotels.

Metasearch sites like TravelSupermarket, Trivago, Skyscanner and KAYAK are most popular with younger people: a quarter (25%) of 25-34 year-olds use them when booking flights, and more than a third (37%) of 16-24 year-olds use them when booking accommodation.

As you might expect, it’s those booking non-package holidays who use these to get the best deal: 22% use them when booking flights, and 35% use them when booking accommodation.

Eilidh Whyte, Group Airline Display and Affiliate Manager, Thomas Cook Airlines says: “I know that Thomas Cook is a trusted brand name, but comparison websites like Skyscanner and KAYAK are actually becoming trusted brands themselves. People trust that they are showing the cheapest price to their customers.”

Booking Behavior by Gender

Our second set of personas revolves around gender – and we found many more differences than expected in how men and women plan and book their travel.

Planning and booking

When it comes to researching and planning a trip, women begin this process earlier than men (4.43 months, compared to 3.83 months) and they dedicate more time to it. This trend is increasing: nearly one-third of women spend more time planning than they did 10 years ago, compared to 23% of men.

When it comes to motivation, women are most influenced by online reviews when it comes to deciding where to go on vacation (44%, compared to 38% of men). Women are also the most cost-conscious: 41% of women, compared to 37% of men, base their decision on the lowest price. In contrast, previous experience is a bigger driver for men (49%, compared to 44% of women) as it was for our older generation (see previous chapter).

Convenience is high on the list of priorities for women during the booking process, with more than half (52%) rating it as important, compared to 48% of men. Both men and women were equally likely to start their booking journey on a comparison site, traditionally associated with travelers searching for the best price – a third each stated that these drive them toward the websites they will look on.

Personalizing the customer journey

Women are less likely than men to be comfortable sharing data with travel brands – 37% would never share data, compared to 32% of men. Men are also more likely to share data in return for an improved service (45% vs. 33% women), while women are still more price-motivated, more likely to share data in exchange for cheaper rates (42.4% vs 41.6% for men).

However, this attitude towards personalization vs privacy was not without its contradictions (as is often the case). Despite expressing less willingness to share data, women viewed websites saving their preferences more positively (54.8%) than men (52%). Women were also more likely to find product recommendations based on previously viewed or purchased products useful (50.7% vs. 47.4%).

For both, relevant reviews were the most liked form of personalization (69% of women and 63% of men rated positively), followed by personalized loyalty schemes (66.9% of women and 66% of men).

What it means for travel marketers

As this section revealed, an additional complication toward delivering personalization is the struggle to access the data necessary. This is especially true when customers research and book their holidays via aggregate sites.

“All of my goals are aligned towards getting our guests to book directly on our booking engine, and not so much via OTAs. When they do that we don’t own the guests as much, they don’t give us their email addresses,” explains Wai Lin Yip. “So how do we make sure our website is offering people value as well as a unique value that they can’t get on Expedia? Perhaps we can offer them that upgrade, or special perks and free drink vouchers when they check in.”

For women especially, ensuring that this unique value is clear is paramount given the fact they are more inclined to be driven by price. Combining this goal with preferred forms of personalization, such as highlighting value via reviews, or incorporating offers into your loyalty scheme could be a way to secure the booking across both visitor groups.

In Focus: Convenience Matters

Nine out of ten respondents (90%) say that the convenience of the booking process is important to them when booking a holiday, with 11% saying that it’s the most important thing to them. Those aged 35-44 are most likely to prioritize convenience (15% say it’s the most important thing) and those booking package holidays (with a travel agent or online) share their view (both 15%).

37% of customers say that convenience and ease of use are more important to them than cost when booking a trip, with 18% of those who use a travel agent strongly agreeing that this is the case.

But be warned against taking this at face value. Although 75% would be happy to book all aspects of their vacation on one site, almost eight in ten (78%) travelers say that they always visit multiple sites when deciding where to go. This implies that the inclination to explore choice can still overpower convenience alone.

Eilidh Whyte believes that the appetite for convenience will increase as it merges with choice: “I think people will want to book more and more on aggregate sites, and that’s something we really have to consider. We need to think about how we deal with these people. If a customer is already logged-in to a website, and they have stored their card details, it might just be easier for them to book everything in one place.”

Booking Behavior by Trip Type

Next up, we’re exploring how these travel customer journeys and preferences differ by the type of travel that the consumer is looking for. We explored six key types of vacation: beach, adventure, city break, cruise, wellness and special interest.

Planning and booking

The key outlier in all of these groups was wellness holidays. It’s here that the biggest shifts have taken place (56% are looking at more sites than a year ago, compared to a 44% average). Our wellness travelers are also the most frustrated, with over 70% of them complaining of a complex and fragmented booking process compared to an average of less than 50%.

Consumers here are also the most likely to be influenced by social media (39%) and of all our holidays types were the most impacted by influencers (21%) and traditional media (21%). Convenience is at its most critical with these holidaymakers, who are the most likely to say that it matters over cost (65%). However, the data implies that all this might come from the fact that these trips are booked at relatively short notice – planned only 3 months ahead compared to an average of 4 months.

Our adventure travelers are comparatively more relaxed – they only start planning 3.7 months ahead of time. While for the vast majority (64%) this timeline hasn’t changed much in the last year – they’re still visiting more sites (43%) than a year ago. When deciding which sites to visit, it’s less about convenience and more about experience for these travelers – 50% are driven by previous experience, 52% by online reviews and 31% by word of mouth. These travelers also rank high for influencers and social media. Unsurprisingly, this group are the least likely to want to bundle their booking together (10% would actively stay away from booking their trip on a single site).

City breaks are where we find the opportunists. The research period is close to average, but this group is the least likely to have branched out in terms of the sites that they visit (37%) – this aligns with the fact that they’re the most likely to base their website choices on previous experience (50%). However, this is also comparison shopping territory – 35% have choices driven by them.

Our other price-driven group are those going on beach vacations. Planning is long here across every element of the vacation, taking 4.3 months in total. Their choices of website are driven strongly by price (52%), closely followed by previous experience (47%) – influencers won’t help you too much here. Convenience in booking is also key – 91% rated it as important in influencing their decision.

The booking preferences of those going on cruises align generally with the trends we saw in the older demographics. Convenience and user experience is paramount here, with 83% more inclined to book vacations on websites that are easier to use – this group were also the most likely to rate convenience as important (91%). Previous experience is key here and the planning period is the longest of all our groups, at over 4.5 months.

Finally, our wild cards – the special interest vacations (i.e. historic sites or religious sites). While this group spend an average amount of time researching where to go on vacation, their digital horizons seem to be the slowest to expand – only 40% are looking at more sites than a year ago, which is the lowest of our report. Like beach vacationers, their choice of website is driven by price (53%) then experience (47%).

Personalizing the customer journey

When it comes to sharing data, beachgoers and special interest vacationers are the most likely to rule this out entirely (36% and 38% respectively compared to a 34% average). By contrast, those going on city breaks, cruises or wellness holidays are the most willing to exchange data for better service or pricing.

Personalization preferences also vary. For the context-conscious adventure traveler, reviews are key – as they also are for the beachgoer who spends a long time planning. For city breaks, special interest and cruises where previous experience is a key driver in website choice, personalized rewards and loyalty schemes come out on top. Finally, our wellness outliers – the only group to rate product recommendations highest (69%).

What it means for travel marketers

“Technology has made it so much easier to plan, book and travel,” says Sarah Hawkins, Senior Digital Optimization Executive, Virgin Trains. The sheer diversity in how this plays out for different types of vacationer show how carefully the marketer needs to adapt the experience.

“People are now a lot more independent,” says Marie Tracy, Group Marketing Manager at TravelUp. “If they’re looking for a package holiday, they just want a good deal and they want a simple booking process. Sometimes they want more than just your standard package, or they want better search options. If they get stuck, they can call us and we’ll do it for them. Or if they want something specific, then we can build it for them.”

Marie Tracy, Group Marketing Manager at TravelUp.

A big part of the lesson here is never to overlook loyalty – for many of these groups, experience is key and perks need to be driven by previous experience. Sam Willan, General Manager UK, StudentUniverse, believes that marketers are missing a trick. He explains: “A repeat booker costs half as much to acquire and returns 2.5 times in income.”

Booking Behavior by Market

Do travelers from the US approach their booking journey differently to their counterparts in the UK? We cut the data once again to see whether approaches need to differ by market.

Planning and booking

American travelers are more likely to find the booking journey complex than their British counterparts (45% vs 38%). In general, they spend less time researching (3.8 months vs 4.5 months) but this is growing at a faster rate, with 29% spending more time on it than a year ago. This could be down to the growing diversity of sites being visited in the US – 47% of Americans cite visiting more sites on their booking journey than last year, compared to 40% of Brits.

How our travelers get to these websites varies, with US travelers appearing more price-conscious. While nearly the same proportion cite price as a key driver in choosing sites (49% US and 48% UK), US consumers make bigger use of comparison websites (36% vs 31%). They’re also more driven by online reviews and social media, where UK consumers rate previous experience more important (51%).

Personalizing the customer journey

Almost without exception, UK travelers were more likely to dislike personalization than American consumers – real-time availability information on what other people are viewing came under the biggest fire, with 35% of Brits expressing their dislike for it.

On the other side of the coin, US consumers were much more likely to actively like personalization – in each of our 9 categories of personalization a greater proportion of Americans than Brits expressed approval. Reviews came out on top, with over 70% of Americans liking – or even loving – these.

However, that’s not the whole story. As we know, consumer attitudes to personalization often come in stark contrast to their openness to sharing data, and this plays out here. Despite being more open to personalization, over 40% of Americans said that they would never be comfortable with travel companies collecting their data. This is a significantly larger proportion than the UK, where 29% would never share their data.

What it means for travel marketers

The conclusions here are particularly interesting because of the apparent contradictions raised. When it comes to personalization, there’s a clear lack of understanding especially among US consumers about the connection between collecting data and delivering personalization. Solving this from a marketer’s perspective has to start with greater transparency.

Elsewhere, while the differences here are perhaps more subtle than what we’ve seen elsewhere in the report, it pays to be aware of the more intense nature of the US customer journey – more sites, less time and more comparison.

Booking Behavior by Product

Our final cross-section of research was driven by the understanding that more and more consumers are booking different elements of their travel separately. We therefore analyzed the booking processes for these different products: flights, accommodation, activities, airport travel and parking.

Planning and booking

The booking journey starts, of course, with researching where to go – around 4.1 months ahead of departure. Flights come almost exactly a month later, at 3.1 months before the vacation. From there, the leap to booking accommodation is quick – this is booked 2.96 months in advance. It’s also at this point that our travelers will be looking for inspiration on activities (2.71 months). Travel to and from the airport comes much later, along with airport parking (1.7 and 1.6 months respectively).

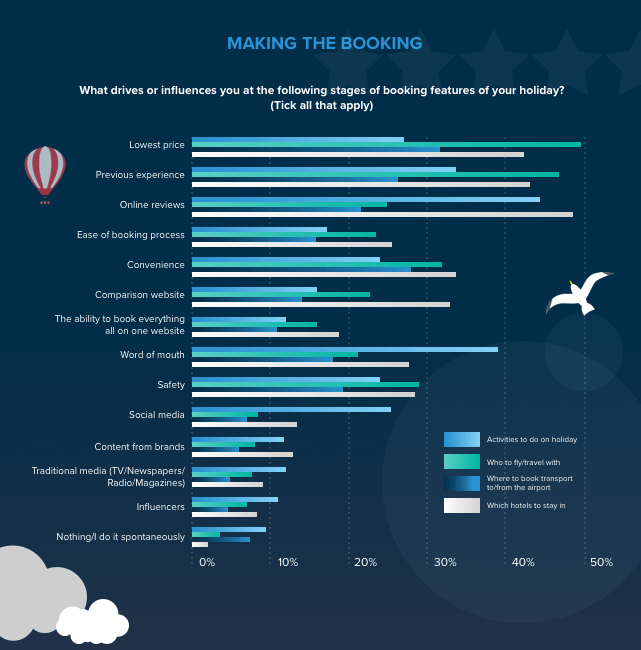

But do the influencing factors change as consumers go through their booking journeys? It turns out that they do. For booking flights, it’s all about price (50%), followed by previous experience, convenience and safety. However, when consumers switch their attention to accommodation this changes – online reviews here are the most important factor (47%), followed by previous experience and then price.

It’s only when consumers start thinking about holiday activities that social proof really comes into play. Online reviews (44%) and word of mouth (38%) rank highest here, and social media also makes the top five (24%) – the only category where it does.

What it means for travel marketers

Depending on where your brand sits in the customer journey, it’s important to time your approaches carefully. Effective retargeting and email nurture campaigns can be pivotal in ensuring that you’re front of mind when your place in the booking funnel comes around.

This is particularly important if you’re looking for the all-important ancillary upsells. Eilidh Whyte believes that customers are most likely to be sensitive to price when they’re booking short-haul trips. She explains: “Customers on short-haul flights are often more considered in their purchase of ancillaries such as meals and baggage. We must work as a brand to sell our products post booking and offer things like buy duty-free ahead of time for a decreased price or champagne for onboard bought ahead of time so there’s no need to worry about cash on the flight.”

Recognising when to target customers is a challenge, but one that can be tackled with behavioral segmentation. Virgin Trains takes this approach with a variety of personas:

“Our customers range from people who’ve never even boarded a train before to people who commute with us every day. We’ve got every type of customer covered that we can think of. From that, we understand the behaviors that each persona may exhibit when boarding, when booking, and post journey as well.

“We use this to target visitors online with our personalization program offering them more information if they need it, or learning to sit back and let them get on with it when they want as well.”

Conclusions

The findings in this report could have filled several volumes – the proliferation of the types of customer journey that we’ve seen in recent years means that there are limitless paths of enquiry to follow.

However, what we hope is that we’ve managed to paint tangible – and as importantly, actionable – pictures of consumer booking behavior.

While there are overarching trends to be aware of – longer planning periods, more sites being visited along the way and a universal focus on convenience – the diversity of opinion beyond that means that success lies in personalizing the customer journey transparently and usefully. As the report indicates, a quid pro quo approach to personalization is more likely to improve the customer experience, boost loyalty and give brands the valuable data they need to secure future bookings.

One of the biggest challenges for any travel brand is encouraging customers to book directly so that they can capture data and use it to build customer loyalty and ensure repeat business — after all, previous experience drives almost half of our respondents’ travel decisions. This is an industry where the pace of consumer behavioral change is fast, and historically where brands have struggled to keep pace – but this is changing.

“There’s so much appetite in the industry for a solution that can help companies adapt to the challenges of a complex customer journey,” says Mark Murray. “I think we’ll see more trailblazers in 2019.”

We hope you’ll be one of them.