EBOOK

Customer Engagement in Online Fashion

Published: Apr 19, 2018

What you’ll get from this guide

At first glance, it looks like fashion has e-commerce all sewn up – customer engagement with online fashion brands is on the rise. Already the top-selling product category online, sales of fashion in the UK increased by 17.2% in 2017.

As the ‘retail-apocalypse’ continues to claim bricks-and-mortar victims, with many blaming a lack of investment in digital channels as the main cause, the way is increasingly open for pure-play e-commerce brands across the spectrum – from ASOS to Net-a-Porter – to continue to build on the 38% share of the online market they already have.

But dig a little deeper and more challenges start to emerge.

For one, online fashion retailers are not immune to the impact of economic issues. And some brands, particularly in the luxury sector, have been a little late to the party when it comes to embracing digital channels. For others, e-commerce budget has been quickly spent on investments like improving the supply chain and distribution or lost due to customer returns – a costly expense of doing business online.

This guide will examine these challenges and other key trends in more detail, and offer actionable tactics and best practice examples to show how fashion and luxury brands can improve customer engagement online, rising to meet the demands of today’s consumers.

Challenge 1: always-on discount culture

Promotions and discounts have become the new normal – as the retail space has become increasingly competitive, and as consumers have gained greater access to information on pricing, they’ve come to expect frequent discounts. Fashion and luxury brands also need to recognize that discount-led behavior is no longer confined to a certain segment, but is exhibited across the board – a recent survey found affluent US consumers earning over $100k are just as likely to look for discounts as more thrifty buyers.

This means that revenue takes a hit – 53% of UK retailers claim that sales and discounts becoming a year-round phenomenon is impacting their sales and profits. And pricing also has a huge impact on brand equity, crucial for products like clothes, so closely linked to personal preferences and tastes.

Despite these negative effects, many find themselves caught in a vicious cycle of competitive discounting, and in a race to the bottom, no one wins. So what’s the alternative when it comes to engaging price-sensitive consumers?

E-commerce customer engagement opportunities

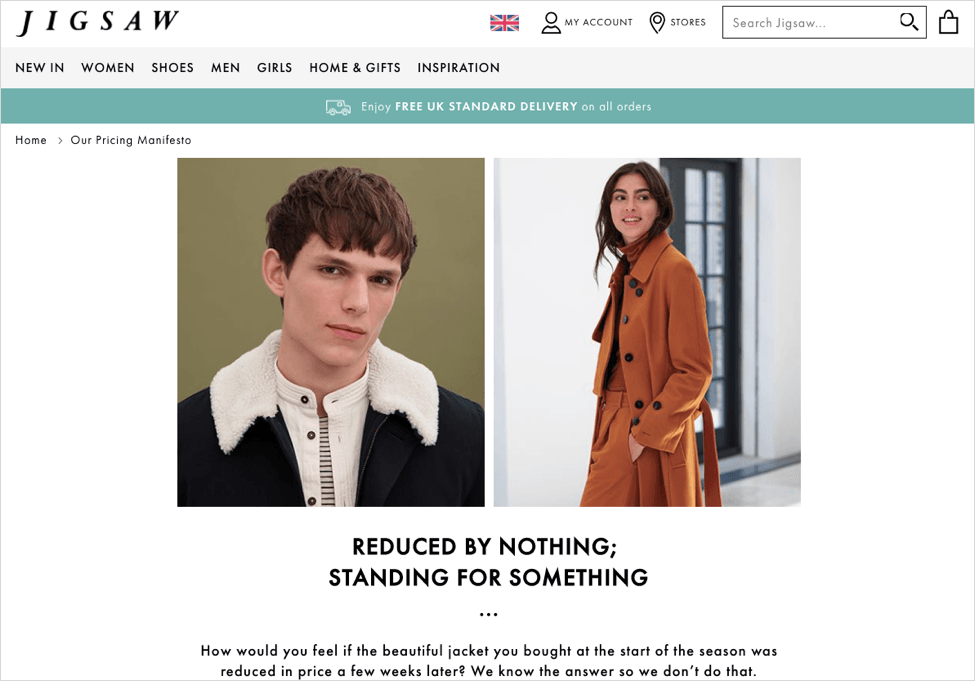

There are two paths that fashion and retail brands can take to break the discount cycle. The cold-turkey approach has seen some fashion brands take a stand against the never-ending parade of markdowns. High street luxury clothing brand Jigsaw implemented a price promise, aligned with the belief that their customers value quality and design over discounts:

This approach of amplifying brand USPs can even be more successful than discounting. Beauty brand skyn ICELAND discovered through e-commerce AB testing a discount versus a USP message, that the latter was actually more effective, driving a 28.87% uplift in conversions.

Luxury brands, in particular, should seek to avoid blanket discounts at all costs, since exclusivity is key to the perception of value. One of the most effective mechanisms is to offer free shipping instead, with studies showing shoppers spend up to 30% more when delivery is included.

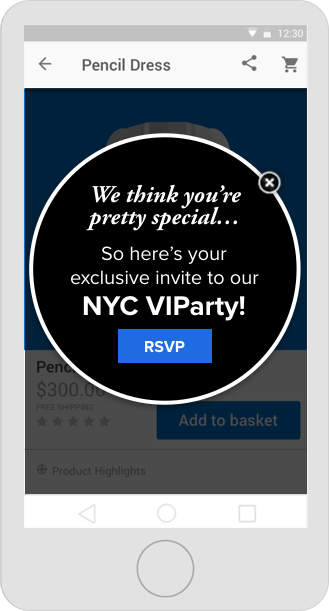

Brands should also consider which messaging and offers will work most effectively with different types of shoppers, as well as the impact on margin. It might be that you’re happy with offering VIPs a discount, because they’re worth more to your business. Determine whether a visitor is new or returning, and if they’ve bought from you before – then deliver personalized messages at the right time, including discounts or other value-adds such as events, personalization services, or gift wrapping.

Challenge 2: weathering the storm

Current economic and geographical factors are contributing to the uncertainty already in play within the fashion and luxury landscape.

A recent example, 2018’s so-called ‘Beast from the East’ cold weather phenomenon, was reported to scare up online sales, as consumers were stuck indoors. Similarly, in the US, the New England nor’easter saw customers stock up on essentials, and luckily avoided December’s peak shopping season when it could have caused real damage. The longer-term impact of these disruptive weather patterns is yet to be accounted for, particularly in an industry so driven by seasonality – spring collections don’t move in sub-zero temperatures, and will inevitably have to be discounted if numbers aren’t hit.

In more practical terms, even if consumers don’t have to come to you, the products still need to get to them. Bad weather can wreak havoc with delivery, and with your brand’s reputation. Even good weather can pose a problem, with climate change resulting in unpredictable weather patterns and high-street stalwarts Next and M&S reporting a rapid decline in their winter clothing sales at the start of 2017, following unexpectedly mild weather conditions.

E-commerce customer engagement opportunities

While unexpected weather conditions aren’t ideal, they do present opportunities to create customer engagement. As mentioned, sales in fashion soared by almost three times during the ‘big freeze’, likely due to shoppers buying clothes to adapt as the weather changes.

If your brand has the ability to respond to changing conditions in an agile way, running campaigns highlighting special offers or relevant product ranges, in the moment of intent then there’s a big opportunity to take advantage of an increase in traffic.

This idea of geo-targeted, weather-focused marketing is something that has historically worked well across other channels, such as advertising OOH or on social media. Ever the digital innovator, Burberry’s weather campaign created ads as fickle as the seasons way back in 2012, and has since inspired similar from Sainsbury’s Tu Clothing (2017) and La Redoute (2014).

Creating this on the website can be even more effective, as it’s a chance to capture those consumers driven to action by the weather at that moment of intent to buy. Rain? Promote those umbrellas. Sunny? Showcase your best selling sunglasses. Even better – target referral traffic from social or ads focused on the weather, and mirror that message on-site.

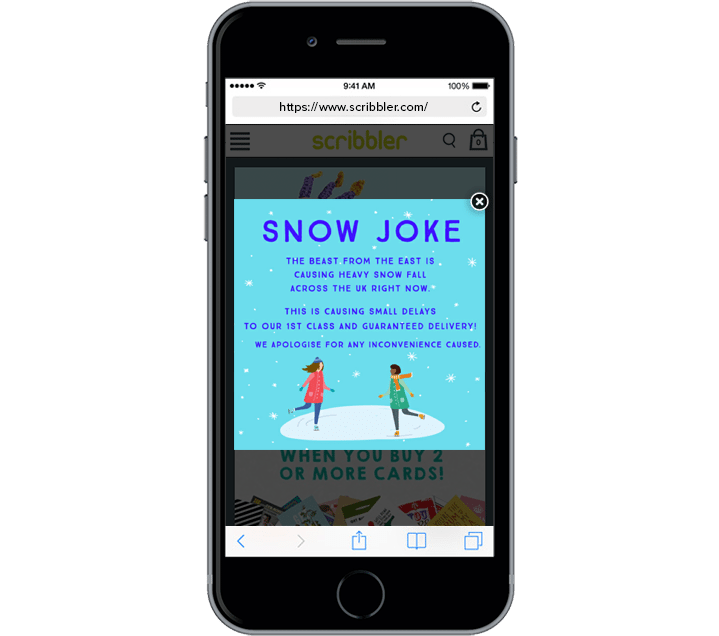

But what about when weather presents more of a problem than an opportunity, such as in the delivery scenario mentioned above? Again, having an agile marketing technology that can serve messages or notifications to customers as the situation changes is key. Stationery retailer Scribbler made sure to give their customers a heads-up when the UK experienced some delivery delays due to the snow. Being transparent with consumers around delays or changes to your usual service is a great way to proactively address issues and build trust with your visitors.

Challenge 3: the cross-border conundrum

Adapting to the weather is all well and good, but what about bigger, economic factors that mean customers just aren’t in the mood to buy? Well, despite the doom and gloom, there are opportunities to be had – recognising these comes down to understanding your website visitors and delivering the right experience for the journey they’re on.

For example, due to currency fluctuations, many luxury fashion businesses are seeing increased interest from overseas visitors due to the marginally more competitive prices, with the UK now the cheapest luxury goods market in the world. While this seems like a short-term opportunity, as the UK’s retailers consider the costs associated with leaving the EU, it highlights a key area for growth – global e-commerce – and the need for online retailers to cater to an international audience.

New audiences, in markets such as Africa, the Middle East and China, are a huge cross-border e-commerce opportunity for brands looking to grow their customer base, and their customer engagement. Few seem to realize this, but China has already surpassed the combined total of the US and UK markets with $750 billion spent online in 2016. Africa and the Middle East are also on the rise, clearing 45 billion in 2016 and predicted to exceed 51 billion by the end of 2017.

So how can fashion and luxury retailers engage these new potential consumers when they arrive on site?

E-commerce customer engagement opportunities

Luxury beauty retailer Lancôme recognized an opportunity with consumers browsing in Chinese – faced with one of the biggest forces in global luxury spending the brand wanted to ensure it was catering to this audience. It achieved this by creating a tailored lead gen campaign, using Yieldify’s Flexible targeting capability to recognize the fact they were using a Chinese language browser, and then targeted them with a welcome message in their language.

Luxury childrenswear retailer Base Fashion – recognizing delivery as a key barrier to conversion for many international visitors – served a message to visitors based in Japan, highlighting free delivery if they spent a certain amount – a smart way to drive conversions and increase AOV, given the delivery threshold of £150.

Taking an agile approach to international e-commerce means tailoring content to local visitors. This is something that UK retailer Marks and Spencer recently talked about at Journey 2018, where Hannya Boulos, Senior International E-commerce Manager shared how the retailer scaled across 32 markets with a simple, personal and local content strategy, and a tiered approach depending on the opportunity (to see the full presentation visit SlideShare).

Challenge 4: the demographic dilemma

Millennials have been blamed for many things when it comes to retail – from the death of bricks and mortar to the growth of discounting, to a lack of sales across a diverse range of categories from diamond jewellery to fabric softener. But in reality, millennials, and their next-in-line, Generation Z, represent a big opportunity for fashion and luxury brands, predicted to spend $1.4 trillion annually by 2020 and account for 45% of the fashion market by 2025.

So what about the other 55% of the market? Baby boomers not only have the most money to spend – but also the most free time in which to spend it. Research states that over-65s spend £6.7bn a year on clothes in the UK, but the fashion industry is losing sight of their spending power and the opportunities they offer.

Clearly, both groups represent an opportunity – but how do you cater to their different behaviors, desires and tastes to engage them online?

E-commerce customer engagement opportunities

Each group has different spending habits, and are influenced by a variety of different storytelling tactics when it comes to choosing their favourite fashions. Get to know your ideal customer inside out to truly understand them and their online journey – and build a marketing strategy around this.

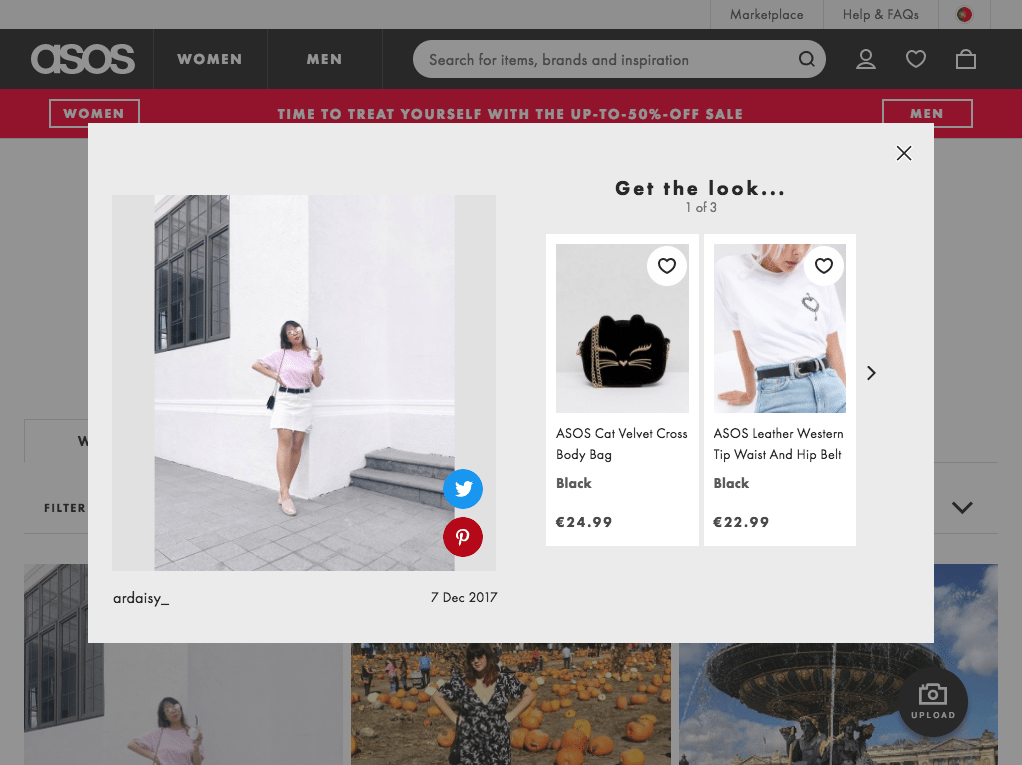

Content marketing is a prime area where you can create high levels of customer engagement, specifically utilizing user-generated social media content to build authority and trust with a sceptical young audience, who are 30% more likely to trust this than baby boomers. Pure-play fashion site ASOS dedicates a whole area on its site to user-generated content, and makes all the images shoppable and shareable, catering to Gen Z’s preference for social shopping.

As well as focusing on the products themselves, fashion and luxury brands are increasingly recognizing the importance of standing for something more when it comes to engaging with millennials and Gen Z consumers. Missguided, the fast fashion retailer aimed at 16-35 year olds, has been lauded for its focus on body positivity, as one of the first brands to embrace authenticity and diversity across its online and in-store models with its #MakeYourMark campaign.

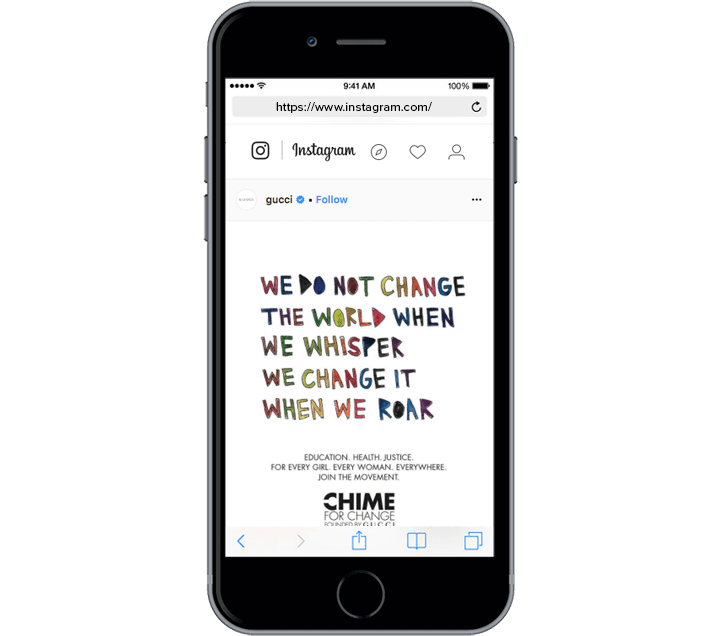

Where appropriate for their audience, brands can seek to get involved in events and social causes, such as International Women’s Day. In this example, luxury fashion brand Gucci launched a new initiative with Chime for Change on their marketing channels.

Mirroring social campaigns like this on-site by showing an Overlay or Notification to traffic arriving from these channels is a great way to keep the customer journey going and engage your visitors further. In the below video luxury candle brand AHLT welcomes visitors arriving from blog SheerLuxe and offers them free delivery in exchange for their email address. To learn more about utilizing tactics like this to market to Gen Z check out our digital masterclass hosted by Maybelline New York.

Like many marketers, we’ve focused in on millennials first, but baby boomers and older older generations shouldn’t be forgotten! And actually, the approach should be much the same – meeting them where they are, and reflecting their self-image, behaviour and preferences in campaigns. While this might mean a greater focus on print and TV, don’t make assumptions – older generations are active on digital channels and some of them are even social media influencers, such as the 88 years young Helen Van Winkle who has garnered over 3m followers on Gen Z channel of choice, Instagram.

Whatever your acquisition method for older audiences, success lies in how you tailor their journey to create customer engagement once they’re on-site.

If Helen hasn’t helped get rid of your preconceptions, then dig into the data – research suggests that baby boomers shop online just as frequently, and spend more per transaction so tactics to increase average order values can be particularly effective on this group. An important area to optimize is the checkout: a report from KPMG showed that older consumers are very concerned about data privacy, so utilizing trust symbols as they progress through to payment is a great way to ensure they don’t abandon their cart and go on to convert (more on the checkout process here).

What is clear from these two ages of fashionistas is one thing – understanding your visitors and tailoring their journey accordingly is the key to success. To take an example from another industry, specialist travel insurer for the over 50’s, Staysure, tested out messaging via overlays to abandoning visitors. They found that asking if visitors would rather speak to someone on the phone was particularly effective, resulting in one-fifth of these visitors going on to complete the quote process instead of abandoning.

Challenge 5: from bricks to clicks and back again

One, perhaps surprising, thing that millennials and baby boomers have in common is that they both enjoy shopping in-store, and place a high value on the in-store experience… they just want different things.

While pure-play fashion e-commerce brands have cornered an impressive share of the market, and online has offered a perfect opportunity to budding fashion brands to operate in vertical markets (so-called vertical e-commerce), in-store is staging a comeback.

As traditional retailers play catch-up in digitising their customer experience, online upstarts like eyewear brand Warby Parker and Missguided, and online goliaths like Amazon, are zig-zagging in the other direction, bringing the online experience to customers IRL.

It’s no longer just a battle between online and offline: for fashion and luxury brands, creating a great customer experience utilizing learnings from both worlds is the challenge.

E-commerce customer engagement opportunities

A big advantage of online is the sheer volume of customer data generated. Leveraging this is what has enabled the likes of Amazon to become so dominant in the online space.

Luxury brands, known for the in-store experience, have an opportunity to capitalize on this idea too. Luxury marketplace and tech-unicorn Farfetch is aiming to do with its ‘store of the future’ concept. Recognizing that physical retail still accounts for a big percentage of designer clothing sales, the luxury e-commerce pioneer is aiming to create an operating system for stores, powered by the ‘offline’ cookie. The aim is to give visibility to retailers on consumers browsing in-store, just as they would have online, and a better experience to the customer.

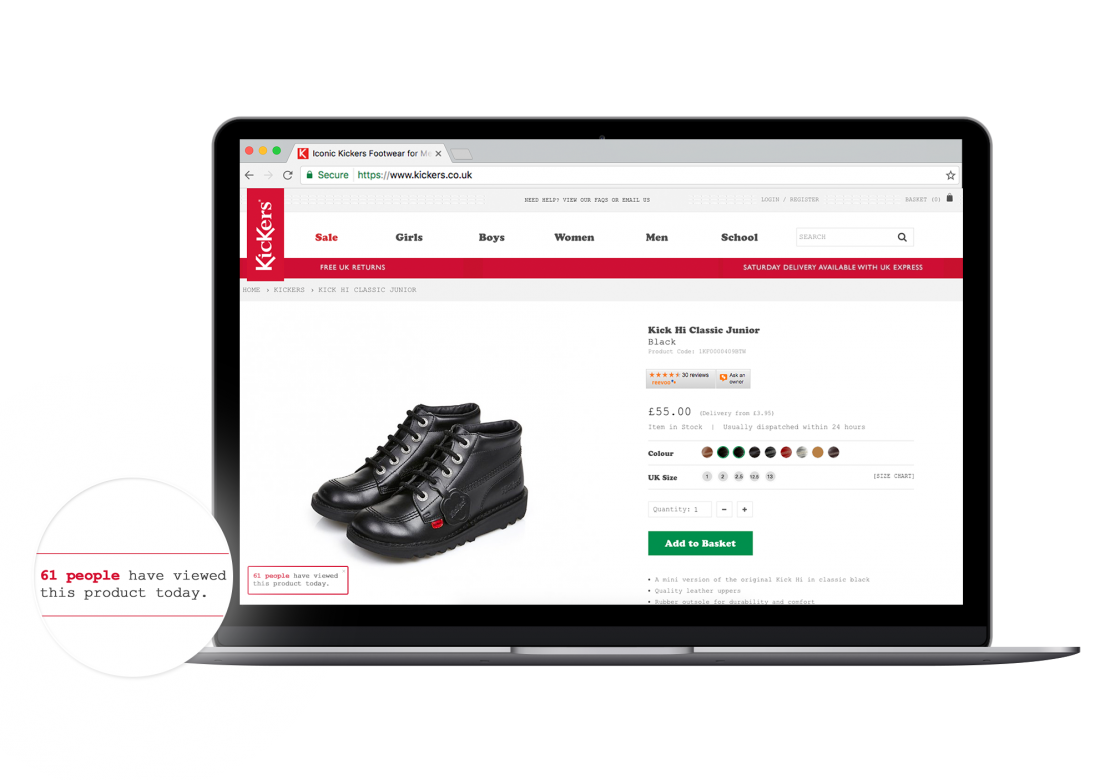

Just as Farfetch is seeking to bring the online experience in-store, fashion brands should also consider the inverse i.e. replicating the experience of offline interactions on their website. This is something that’s already within reach, and can be achieved very simply. For example, Dynamic social proof is the perfect way to recreate the rush of shopping in a crowded store to drive conversions. Iconic footwear brand Kickers, achieved an 18% uplift in conversions by displaying a subtle Notification on product pages indicating how many other people were viewing that style.

One of the biggest challenges for online retail is the fact that you can’t recreate the tactile experience of trying on clothes in-store. This contributes to the problem the industry is facing with returns. Consumers return products they buy online for a variety of reasons, and fashion brands report one of the highest rates of any category, between 20 and 40%. It’s a huge problem due to the knock-on effect of essentially taking these items out of the stock pool when they’re in season, only to be returned at a later date and perhaps discounted, further damaging margin.

There are a few simple changes that retailers can make to combat this and create better customer engagement:

- Quality check your product descriptions: while many retailers have invested in fancy functionality to showcase products in terms of imagery and video, 70% of returns are still made because the size or colour is wrong. Go back to basics – are you describing the item in the clearest way possible?

- Be transparent about the process: if you have an excellent returns policy then shout about it! This will give consumers peace of mind and help drive conversions, especially for high-ticket luxury or personalized items.

- Combine online and in-store: if you’re a multi-channel retailer, you should be offering multi-channel returns or you’re risking future custom. The benefit for the retailer with this is getting the products back in-store sooner, avoiding the delay in having products tied up in the postal system, as well as driving footfall in-store (and a bonus: this option is particularly popular with millennials, 55% prefer in-store returns).

Conclusion

While fashion and luxury retail are facing challenges, there are clear opportunities for savvy-brands to succeed online experience. The rich data that the online customer journey optimization insights provide as visitors navigate through your site holds the key to identifying the opportunities, or as we like to call them ‘moments of truth’, specific to your business.

When digging into this data for yourself, keep the following in mind:

- Break the discount cycle: test and learn what your visitors respond best to – are you giving away margin with discounts when you could be leveraging your USPs?

- Stay agile: real-time marketing is now a reality, and consumers expect it. If the weather is relevant, make use of it – or if you’re seeing an influx of consumers from a new geography, tailor the experience to welcome them.

- Understand your audience: who are your real customers? Where do they interact? What are their expectations?

- Learn from in-store: as we revealed, it’s far from dead, and it’s still highly valued by fashion consumers, so recreate the experience online where you can.

- Get some help: if you’d like some help identifying your moments of truth you can book a free consultation here.