EBOOK

Building Travel Customer Journeys That Convert

Published: Jul 10, 2018

It’s the journey, not the destination

Foreword by Lee Hayhurst, Travolution Editor

The digital customer journey in travel is among the longest and most complicated of any online business and yet many brands focus on just one thing: optimising for conversion.

This report sets out why travel brands need to take a step back and take account of the entire consumer journey, from dreaming and inspiration as visitors research their next adventure, through to experiencing and sharing as they set out on the road.

Travolution has worked with Customer Journey Optimization specialists Yieldify to interview CMOs, Marketing Directors and more, from a diverse range of travel brands across cruise, deals sites, hospitality, tours and transport. All see very different online customer behaviors, and with this have identified very different customer journeys.

Despite this, what’s very clear is the common challenge they’re facing – how to deliver the experience visitors are looking for at a particular point in their journey, be it browsing, booking or beyond.

While many brands are at the early stages of mapping their customers’ journey, all are acutely aware that winning online today requires this understanding in order to provide the optimum experience.

So, let’s take a look at why this is so important and the potential pitfalls our interviewees identified.

The online travel challenge: From CRO to CJO

Travel is one of the world’s most lucrative e-commerce industries, with some 44% of sales and bookings expected to occur online during the next five years. That’s four times more than retail (11%), yet it’s clear from the behaviors we see that many consumers are frustrated by the experience of booking online.

Failure to understand customer intent results in high bounce rates and cart abandonment levels, customers being reacquired again and again from search, and a lack of long-term loyalty.

“The digital travel experience differs for everyone. Some people love travel research, some people absolutely loathe travel research. That’s a challenge we often think about.

Searching 30 websites seeing hundreds of thousands if not millions of results, that’s a lot to take in. We are starting to look at reacting to users’ intent and provide unique experiences.”

Ross Matthews, Chief Marketing Officer, Icelolly.com

What does this mean for travel companies? Well, when you look at the numbers it seems there is a disconnect. Despite the evidence from consumer behavior, the industry is still heavily focused on acquisition.

It’s estimated that $11.2 billion of Google’s annual revenues come from travel, half from the big three global giants; Expedia, Booking.com and Airbnb. According to a recent study, in the first quarter of 2018 the top four OTAs in the UK spent a combined £45.77 million in paid search on Google.

So the temptation to try to convert every single web visitor as quickly as possible is understandable, and yet studies show they’re not all ready to convert, in fact as many as 96% of visitors on travel sites do not want to convert, according to Google.

The latest Expedia Media Solutions study into British travelers’ paths to purchase shows nearly two-thirds of Gen Z, Millennial and GenX travelers haven’t even decided on a destination when they begin researching. The figure is 45% for baby boomers.

High-spending baby boomers are the least fixed in terms of budget when they are researching and booking trips; appealing deals, imagery, and content, when promoted correctly, can influence their final decision.

The challenge is identifying signals of intent, according to Renée Dyson, Head of Marketing at Best At Travel:

“We use a combination of expressed and implied preferences, and are trying to be more agile with how we segment our data and identify real-time assumptions of intent. We still very much look at basic data sets such as keywords to try and identify where a consumer is in the buying cycle.”

So much is up for grabs when a user lands on your site, but not every visitor is the same or looking for the same experience.

They will also behave differently according to what type of product they’re looking for, so a mass market deal-finder will be very different to someone contemplating a cruise, a long-haul escorted tour or a villa holiday.

The typical approach of conversion rate optimisation (CRO) is to try to optimize for the baseline of visitors, but that just ends up with a generic experience for everyone.

Customer Journey Optimisation (CJO), on the other hand, means taking a data-driven approach to improving the whole journey to get more conversions. Marketers are empowered to create contextually-relevant messages that add value to the customer experience, rather than the traditional ‘line of best fit’ approach seen with CRO.

“ Customer Journey Optimisation is a really big conversation. Compared to the early days in digital things have got a lot more complicated. We see more, we understand more, we have more insight but having that data means you have to work a lot harder. We are all used to looking at the dreaming, planning and converting but now you are going beyond that.”

Mark Bloxham, UK Managing Director, Wendy Wu Tours

One key aspect that’s changed in the past few years is that customers, especially in travel, are expecting a consistent experience across different channels.

To be able to deliver this, brands need to have tools that allow them to integrate and understand their customers. They need triggers for how to respond based on customer behavior.

“While we cannot always assume an individual site visitor is at a specific stage of their conversion journey, we can tailor tests based on how they are behaving. Each will require a different experience for the user. Our client’s expectations are being set by their interactions with big brands with vast budgets for onsite personalisation and optimisation, and we’re on a continual quest to ensure that their experience isn’t inferior to the last site they visited.”

Renée Dyson, Head of Marketing, Best At Travel

Many websites in travel try to direct users straight to conversion without trying to take into consideration the research and discovery aspects of the journey.

And in travel the low frequency of purchase brings particular challenges in trying to assess someone’s intent based on past buying behavior or other engagement.

“The biggest challenges we currently face are fully understanding the complex and changing journeys of consumers, which is further hindered by the infrequency of purchases and a lack of historical first-party data, and joining up the offline and online journey, while ensuring each stage is relevant to mindset and motive.”

Chris Ford, Marketing and Digital Manager, Stansted Express

Another complicating factor in personalising the experience to an individual is the same customer could be a family client one week and a corporate traveler the next. The biggest trap companies try hard to avoid, but often end up falling into, is bucketing users once and then leaving them in that bucket.

“One of the biggest mistakes is putting all customers into one bucket. Definitely customers aren’t all equal, each segment has different requirements, so we need to be able to sensibly break our customer down into discrete groups.

A one-size-fits-all approach means inevitably you are going to irritate 80% of the customers that come to your site.”

Jonathan Starkings, EMEA Travel Director, Groupon

There are times when reacting to customer behavior within the current session and the context of their search activity is almost more important than knowing their history. Particularly in a post-GDPR age, being able to react to intent signals to provide contextual value, rather than using ‘identifiable information’ to personalize the experience is something that brands like Skyscanner are now focusing on.4

Finally, there is a huge challenge in measuring the value of these approaches. As Romain Sestier, Founder of Upper.ai and Head of Product and Data at Yieldify speaking at EyeForTravel Europe recently put it:

“You only get answers about what you’re measuring. If you’re measuring the wrong thing you are going to get the wrong insight out of it. Too many people are just focusing on conversion rate.

My favourite metric is revenue per visitor because it encompasses the average order value as well as the conversion rate.”

From collecting and accessing the relevant data in the first place, right through to measuring the outcome of optimisation efforts, it’s clear there are a few challenges along the way for travel marketers seeking to create better experiences for their visitors. So now let’s take a look at how marketers at brands like Villa Plus, Icelolly.com, P&O and more are building customer journeys that convert.

How travel brands are building customer journeys that convert

So if a one-size-fits-all approach isn’t right for either customers or travel brands, how are companies facing up to the CJO challenge?

In this section of the report, we talk shop with our contributors, to understand the areas where they’re making strides when it comes to CJO.

Read on to discover why social proof is ‘vital’ for Villa Plus, the two consumer trends driving the Stansted Express strategy and how Wendy Wu and Flight Centre see online and offline working together.

Harnessing the power of social proof – Villa Plus

Villa Plus is a specialist provider of villa holidays, predominantly trading online but also operating a call centre. Online Marketing Manager Chirac Shah said it faces the challenge of providing the content users are looking for when they want it, at scale and tailored to their device.

The firm is starting to invest more in its technology having focused in previous years on building the brand, product and customer service.

“As our IT resources grow, our capability in being able to deliver better on-site user experience will get better and better,” Shah said.

“At the moment, the way we deal with this is simply through someone’s position in the acquisition funnel to ensure the content we provide fits around the intent we see.”

Villa Plus already knows from its data that new customers are generally more interested in researching destinations while returning customers are more focused on the property.

In the future, Shah said Villa Plus will use more intent signals to offer greater personalisation so that it differentiates itself in the marketplace.

Shah said due to the nature of the product the villa customer is typically looking for a lot of information and reassurance because the sector is a favourite target of fraudsters. Villa Plus will make greater use of product reviews as it looks to better exploit the power of social proof, which Shah said is vital throughout the user journey.

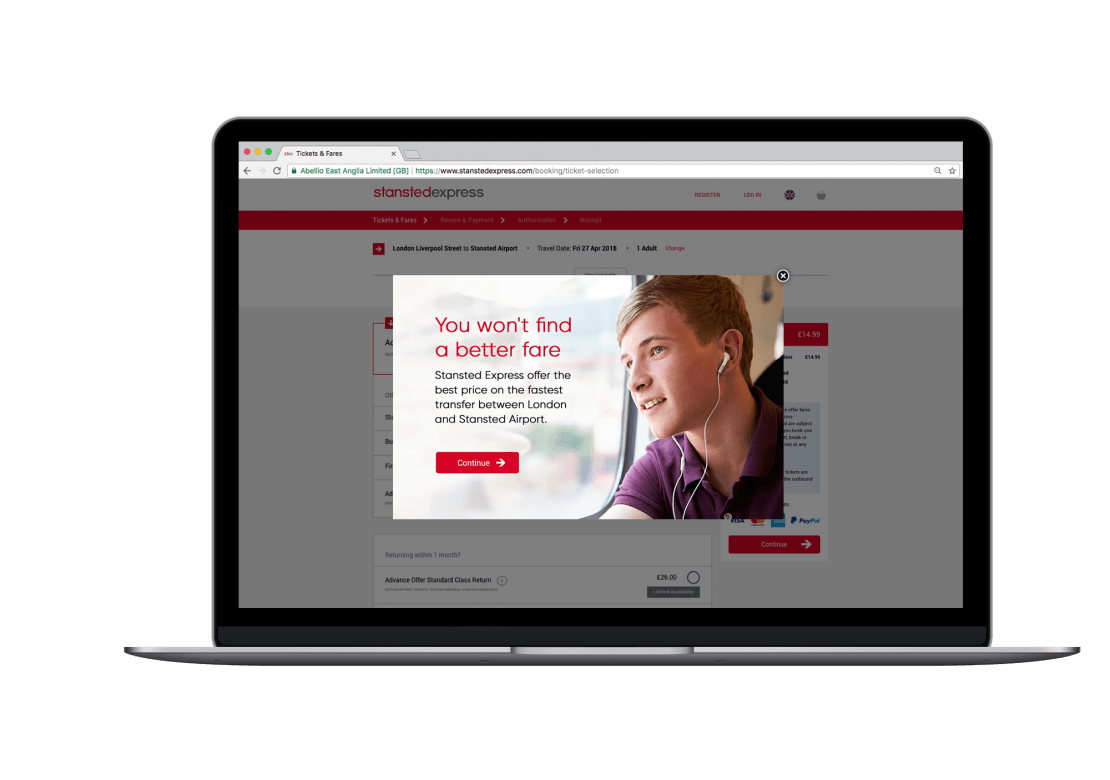

Adapting to changing customer behaviors – Stansted Express

Stansted Express is facing two distinct emerging trends in travel: the increasingly on-demand lifestyle of the customer today and the ‘savvy’ shopper who seeks deals and reassurance.

Chris Ford, Marketing and Digital Manager, said: “To better understand the online customer journey we have begun a digital transformation programme, bringing in digital expertise, refreshing our approach to behavior analytics and social listening.”

“The biggest challenge we have faced here is driving clean, quality traffic to site so we aren’t skewing the numbers in our analytics.”

“To further understand customers we are looking to implement online chat functionality to ensure we also are collecting qualitative data on pinch-points, to drive improvements for our customers.”

A complete review of all customer touchpoints is being undertaken by Stansted Express.

This has seen the brand identify media partners that are influential in the dreaming and planning phase that can communicate the benefits of booking early.

Call-to-action messages in adverts are now clearer, highlighting convenient payment options; social listening and audience engagement are used to provide reassurance.

At the lower end of the funnel, price overlays communicating that customers will not find a better price elsewhere are being used to reduce cart abandonment.

Ford said more improvements to Stansted Express’ site are planned to further aid and influence the customer journey.

“To meet the needs of our audience we are looking to anticipate needs based on signals and personalize information to ensure it’s relevant and helping customers to make decisions.”

“We understand travel can be stressful, so we are also working hard to reduce the funnel and make it easier to convert on mobile,” said Ford.

Offline and online working together – Flight Centre and Wendy Wu Tours

In travel, as in many other industries, companies are looking to integrate their offline and online data sets and operate ever-increasingly in an omnichannel way.

Flight Centre has customer touchpoints throughout its stores, brands and across channels, meaning it has a multitude of data sources.

Becky Duffin, CRM and Marketing Manager, said the brand is working in a number of ways to improve the user experience, ensuring that data does not sit in silos:

“We get tests out quickly to market. We then use the results of these tests with our customers to improve our customer journeys.”

“We are continually improving our single customer view by plugging in multiple data sources to segment our customer base by engagement and geo-demographics.”

“And we are working on market research to understand more about consumer perceptions of our brand and its position within the marketplace.”

Flight Centre has also adopted agile development for constant release of website updates and analysis of their impact.

This approach has resulted in a number of strategies to deliver personalized services throughout the customer journey.

Triggered emails are sent to follow up a quote or brochure request, post-purchase and to encourage re-engagement with past customers.

Segmentation is identifying the brand’s most valuable customers and past customers are connected to individual consultants they have dealt with previously.

Social proof, through reviews and ratings, is being used prominently in advertising and on-site and website visitors are being retargeted based on their previous behavior.

Finally, the company uses A/B testing wherever possible, but in particular on any calls-to-action, to determine what drives the best results.

Wendy Wu Tours is at a relatively early stage of its digital transformation, having launched a new website built on its own in-house technology last year.

However, it now has user experience experts in-house looking at all aspects of the customer journey, in particular, the research phase which is vital for a complex and high-value product.

Mark Bloxham, UK Managing Director, said: “Our consumer type is older – we have a long consideration period and a high cost of purchase.”

“So everything is against us to become a massive multi-transactional site. We are at the opposite end of the spectrum to a booking.com.”

Bloxham said the natural complexity of the Wendy Wu product means potential customers are looking for lots of information and so are not necessarily in the market to book.

Four key aspects of the research phase have been identified.

Number one is confidence in the company, number two is where they are in the funnel and what the company knows about them, and third is what sort of product they are looking for.

The final stage brings the previous three together and informs Wendy Wu what next step it should offer to the customer at that point in time.

This could be a detailed answer to a very specific question, or it could be time to drive them to an interaction with the contact centre.

Wendy Wu is driving better-qualified leads to its call centre as a result and return on investment in digital is being calculated on “web contribution to overall sales”.

However, as customers become more confident booking online, the firm expects the call centre to evolve from predominantly sales and reservations to customer service.

Bloxham said: “It’s the stuff we cannot see that we struggle with at the moment. We still have customers who phone up out of the blue and don’t seem to be in any funnel.”

“If people are interested in doing a more high-cost itinerary or a more complicated tour they could have gone to another operator, done all their research and decided to check us out.”

“But today it’s rare that we see a consumer who comes to us indicating they’re in the market to purchase without the influence of the website.”

“We are not getting all people’s backstory but we are getting a good chunk of it to know enough about them to provide them with what they are looking for.”

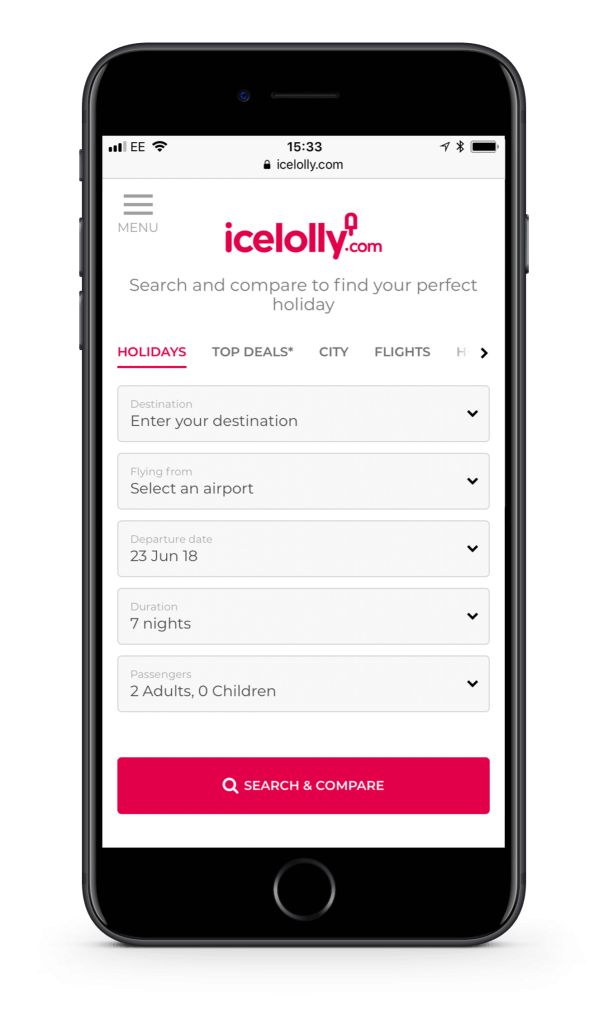

Being more human – Icelolly.com

As meta-search sites have evolved to challenge traditional OTAs with “book now” features, and the likes of Google and Amazon have thrown their hats into the search and booking ring, Ross Matthews, Chief Marketing Officer, Icelolly.com shares his thoughts on how online and offline businesses can team up to compete with the tech giants and offer traveller-friendly experiences.

“We have some fantastic high street travel agents in the UK but they don’t have access to meta-search.”

“At Icelolly, 70% of our traffic comes on mobile so we can infer the location of somebody and put that user in touch with a local high street travel agent under the right circumstances.”

“You can imagine user scoring to identify someone that is showing those attributes for a high ticket value product, maybe a cruise or multi-centre type break, and offering them the opportunity to go and speak to someone about that travel planning.”

“It’s about being more human, but we need engagement from both sides, from the supplier and the high street, to do that link up.”

Mapping the online customer journey – P&O cruises

Leading UK cruise operator P&O Cruises and sister brand in the Carnival UK group, Cunard have just completed a project to map the online cruise customer journey.

Christopher Edgington, Marketing Director, said this was carried out in parallel with a mapping exercise of the “ideal” holiday journey.

The operator aims to use this insight to identify areas where its approach can be simplified to provide the optimum experience.

Edgington said: “We have documented every point of the cruise journey and every point of what we believe is the ideal holiday journey in order to make sure we are relevant to people who have never cruised before as well as those who have cruised with us.”

“One of our values is to be guest-obsessed so we have reconstructed the entire above-the-line journey and that has told us where our current gaps are, as well as opportunities to elevate and differentiate cruises from other holiday types.”

A key gap discovered was that there was not a consistent “voice” being presented to clients across their journey and therefore there was not an “effortless experience” being offered online.

P&O Cruises is addressing this in three areas – people, processes and technology – to transform its digital experience.

“Our plan is to sort out internal processes to simplify them to make it easier for the guest”

“The world is fairly simple, but in a digital age everybody expects access to everything instantaneously and with that comes complexity.

“What we have done is sweep that back to very simple basics to deliver an effortless customer journey.”

21 Edgington added he considers the work described above as a “hygiene factor” in today’s digital marketplace, but a vital one to get the basics right to build on and go beyond.

And he expects the impact to be felt beyond just the digital experience itself but to feedback to the way the onboard experience itself is merchandised, sold and delivered.

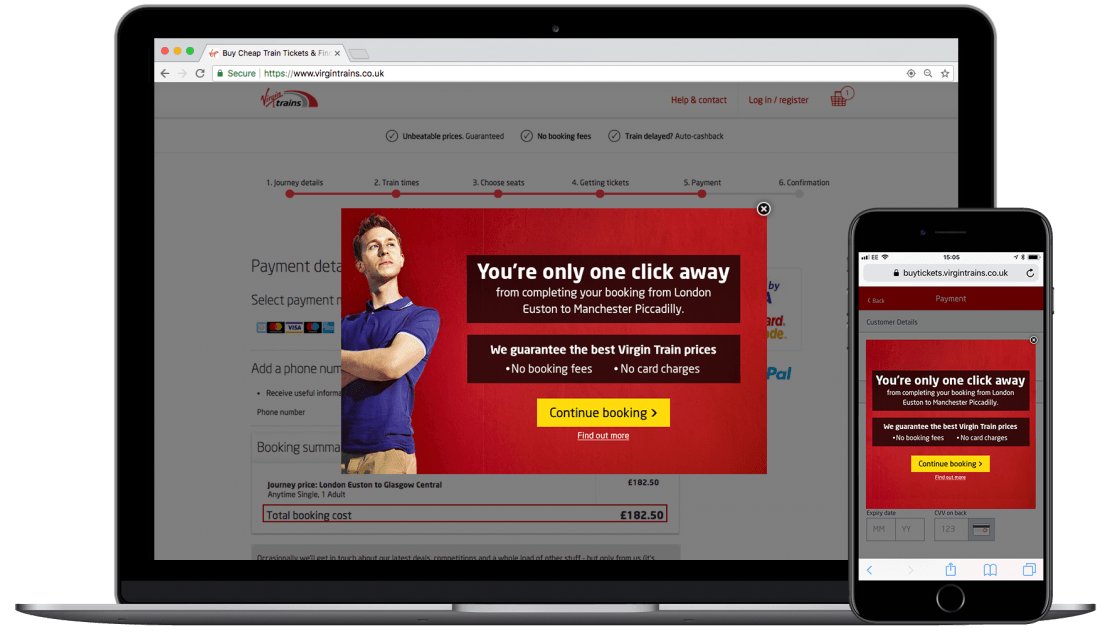

Keeping visitors onboard throughout the booking funnel – Virgin Trains

With high levels of competition and even higher commuter expectations, domestic train travel has become a customer-centric market. As the top rated long-distance rail franchise, Virgin Trains has put customer experience at the top of its agenda.

With the dual goals of increasing booking and growing brand loyalty, the brand delivers relevant messages to users at the perfect point in their journey to keep them on track to convert.

An important part of this has been focusing on those visitors within the booking funnel, recognising when they become disengaged and serving reassurance messaging and highlighting USPs.

For example, Virgin Trains saw a +7.3% uplift in conversion rate by targeting visitors abandoning seat reservation pages, and a +16.6% uplift from visitors abandoning payment pages (read the full case study here!)

Conclusion

What’s clear in travel is that too many sites are trying to convert recurring visitors straight away when they should be nurturing a relationship over the longer period of time.

In acquisition, meta-search is dominant and the biggest problem is that high bounce rates and average booking values are low because people are more price-conscious.

Instead of conversion rate, a better metric to use is revenue per visitor, because this encompasses the average order value as well as the conversion rate.

Retention is also key for today’s travel brands not only due to rising acquisition costs but also the high expectations of consumers. The brands featured in this report have recognised that by optimising the customer journey, they can drive greater loyalty and lifetime value.

But what’s at the heart of all this is the customer. Travel can be a fiendishly complicated sector – but that should remain behind the scenes.

Companies that do the hard work for their customers, by providing digital experiences that match the trip itself, will have the best chance of success.